Trader Education - Traders Get Help

Expert trader teachesis the best way to get trader education

In 1999 I started trading and still remember the days when I didnt think I would ever become a professional trader making money from my computer each day. It took me 2 years of solid reading, seminars, DVD's and spending time watching over the shoulders of a few very good traders.

I explored most of the financial markets learning about stocks, options, swing trading, day trading, futures and forex. After testing the waters in each area I decided to master trading ETFs using swing trading and day trading as my main source of income.

If you are just starting out you should really think about what you want to trade and your time frame. Then find a trading coach of technical analysis trading service like mine to help you learn and earn at the same time for a monthly fee. Asking questions and watching trades is the best way to learn fast.

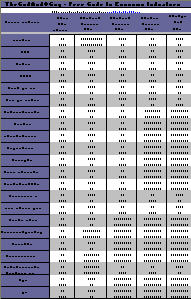

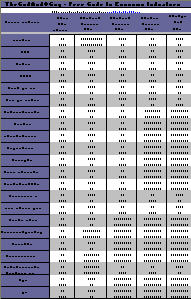

Please download my free economic indicator guide as it will give you some trader enducation about what moves the markets. Its a small step in the right direction.

Download My Free Trader Education Table

Free For Novice Traders

Over 20 economic indicators are provided in a simple 1 page chart it shows you how each of the top indicators effect the Stock Market, Bond Prices, US Dollar, and the Spot Gold Price. Knowing what each indicator effects will improve your results as an investor.

Everyone beginner trader needs this simple guide and the best part is that its FREE.

Become A Better Trader

Some of the main economic indicators for navigating the financial stock markets are Interest Rates, GDP, Unemployment Rate, Retail Sales, Industrial Production, Housing Starts, Personal Income, New Home Sales, and Business Inventories. These are just some of the main leading indicators to look at. |

|

GET MY FREE WEEKLY TRADING REPORTS & ANALYSIS

The Basics of Trader Education

Investors in stocks can be broadly classified into two categories which are long term and short term traders. Long term traders are classic investors who invest in the stock market with long term perspective in mind. They typically look for returns in terms of dividend and appreciation of share price in the stocks over a period of time. They are not keen speculation and on day to day to day price fluctuations. The focus is generally on blue chip companies with established track records.

The other category of traders are short term investors using swing trading and these people are try to profit from the price fluctuation that occurs on daily basis. Many of these people trade for a living but it can also allow individuals with full time jobs to trade as well. Swing traders buy and sell shares, futures or options from their computer connected to stock exchange through high through their online broker.

Both types of investors need trading education. One needs to be aware of the various nuances involved in stock trading as well as the current information about the stocks he/she is interested in. Trader education is very important as you are up against some of the smartest people in the business. One can obtain trading education by attending classes, seminars conducted by specialists in the field. They usually involve some fee. You can also acquire the required knowledge online through many websites like www.thegoldandoilguy.com. Free education on trading and the stock market is provided on many sites.

In order to make the right stock selection, there are 2 widely used methods called fundamental analysis and technical analysis. Both the methods are generally taught as part of trader education. Fundamental analysis involves looking at a company’s financials, its operations vis-à-vis its competitors, analyze present and future business prospects of the company and then determine whether or not the present share price reflects the underlying value of the company.

The technical analysis part of trading education looks purely at the stock price movement, trading volumes, moving averages etc. It involves analyzing stock price movements over various periods of time viz. daily, weekly, monthly etc. in order to detect patterns in price movement. There are many statistical tools available to aid the chart analyst.

Despite many tools and advice from experts available, one must be aware of the downside risks involved in investing in stock markets. Proper trading and stock market education would mitigate the risks to some extent.

Everyone is a novice trader at one point in their life, I hope you find this handy!

To Your Financial Success,

Chris Vermeulen

The Gold and Oil Guy

|