How to Trade Oil

Oil Trader Provides Excellent Oil Charts

Exchange traded funds are recently created investment vehicles that track underlying indices and are traded in stock exchanges like stocks. The US oil fund (USO) for example invests in futures contract of West Texas Intermediate light sweet crude oil as traded in the New York Mercantile Exchange and is traded in the AMEX. Unlike mutual funds, ETF shares can only be traded in a stock exchange and are not redeemable like units of mutual funds.

I learned how to trade oil 2004. you can see my most recent charts whic cover gold, oil and silver by clicking the link below.

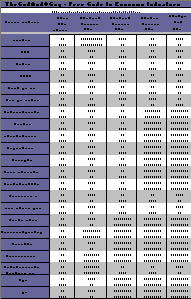

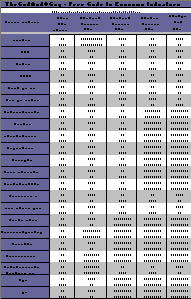

Receive My Free Guide to Economic Indicators & Special Reports

Free Trading Table Shows It All

Over 20 economic indicators are provided in a simple 1 page chart it shows you how each of the top indicators effect the Stock Market (oil stocks and etfs), Bond Prices, US Dollar, and the Spot Gold Price. You will also recieve my weekly special report on gold.

Become A Crude Oil Trader

Some of the main economic indicators for navigating the financial stock markets are Interest Rates, GDP, Unemployment Rate, Retail Sales, Industrial Production, Housing Starts, Personal Income, New Home Sales, and Business Inventories. These are just some of the main leading indicators to look at. |

|

GET MY FREE WEEKLY TRADING REPORTS & ANALYSIS

The Basics of How to Trade Oil

Oil is an essential commodity for all industrialized economies of the world and the demand for oil is soaring as industrialization is picking up pace. In keeping up with the demand, the price of crude oil has risen over 10 times in the last decade alone. One can participate in this booming market by trading in the oil commodity market or through exchange traded funds exclusively devoted to oil. There are 9 such oil ETFs traded in the US and UK stock markets.

Exchange traded funds are recently created investment tracking vehicles vehicles that track underlying indices and are traded in stock exchanges like stocks. The US oil fund (USO) for example invests in futures contract of West Texas Intermediate light sweet crude oil as traded in the New York Mercantile Exchange and is traded in the AMEX. Unlike mutual funds, ETF shares can only be traded in a stock exchange and are not redeemable like units of mutual funds.

The 5 US based oil ETFs are the Claymore MACROshares Oil Down Tradeable Trust ETF (DCR), Claymore MACROshares Oil Up Tradeable Trust ETF (UCR), Goldman Sachs Crude Oil Total Return ETN (OIL), PowerShares DB Oil Fund (DBO) and United States Oil Fund (USO).

Since ETFs are traded just like stocks, their price movements can be tracked through charts. Trading signals are identified through technical analysis. Websites like thegoldandoilguy.com provide expert help in chart analysis of oil ETFs. Subscribers are informed of trade alerts like sell and buy signals through emails.

Oil Advisories are also issued by oil market analysts whenever oil prices are likely to be influenced by happenings in the world like natural calamities, war etc. Decisions made at OPEC meetings also influence oil prices strongly. Thegoldandoilguy.com keeps its subscribers informed of such oil advisories. Personal guidance of each individual oil stocks that one is holding through stock chart analysis is given. Multiple time frame charts for each stock, detailed analysis indicating support and resistance levels, long and short term trend indicators, protective stop losses and buy/sell and profit taking zones are all provided to subscribers of the service. Some of the tools like MACD (Moving Average Convergence Divergence), price relative, break out buy signal, upside and downside reversals are used to minimize risk and increase profit per trade. For more information visit thegoldandoilguy.com website now!

Everyone is a novice trader at one point in their life, I hope you find this handy!

To Your Financial Success,

Chris Vermeulen

The Gold and Oil Guy

|