On Wednesday, January 28, 2015 it was early afternoon during the trading day and I arose from my screens to go grab a drink out of my refrigerator. In the process of grabbing a drink, I went out to see what came in the mail and to get a few moments of fresh air before the final hours of a fairly quiet trading day were through.

Upon reentering my office, I noted that my screens were flashing red and the S&P 500 was under assault from the sell side. I scanned several independent blogs I follow for a headline and came across nothing. It was at this moment that I did the unthinkable and I turned on CNBC. I am embarrassed to even admit it frankly, because the drivel CNBC and most of the financial media spew out might as well be sales material for the sell side and their “long-term investment view that is always bullish”.

I saw the S&P 500 under pressure and then a subsequent bounce occurred. Nothing major, not even what I would call a major retracement, just some short sellers locking in a few profits I presumed. To my absolute horror, seconds later I recall seeing the headline at the bottom of the television screen on CNBC dictating that “stocks were off their lows”. It is no wonder CNBC’s ratings are absolutely terrible.

While I am picking on CNBC, the mainstream financial media is just awful. In fact, I do everything in my power to ignore all sources from televised media such as CNBC and Fox Business to written media like the Wall Street Journal. In every case, every day stocks are going higher and they can never go down. Certainly with central bank omnipotence and sorcery, it will not be long before no one has to work and we will just own long only stock portfolios. [Sarc :)]

Regardless, I am an options trader who has weathered the storm fairly well. I sell premium, focus on implied volatility, and I use probability to build my trades. My style is similar to Tom Sosnoff’s for those following him on TastyTrade or Dough, but I mix in a few twists. Regardless of my trading style, I have a strong historical track record that I am proud of which has handily beaten the markets for several years, although 2014 was one of my worst year in recent memory.

The reason I mention this is simply to state that I am a trader first, and newsletter operator second. I am getting rich with my newsletter at $20 per month let me tell you. Honestly, I just send out trades. No fluff, no nonsense. I tell it like I see it and I admit when I am wrong. My trades typically have a 60% – 70% probability of success at the time of entry based on implied volatility calculations involving probabilities. At the end of the day, I trade options because I am a junkie . . . I absolutely love derivatives and trading them.

As such, some of my recent research at various independent blogs paired with what I can see in the options marketplace has led me to believe that the S&P 500 Index (SPX) is going lower in the next 6 – 12 months. I want to be clear that I am not calling for a crash nor am I saying that the S&P 500 Index will remain under pressure, I am just simply calling for a correction in the very near future, although the situation could deteriorate into something much worse potentially.

However, here are a few data points worth considering which were originally posted by Tyler Durden at www.zerohedge.com:

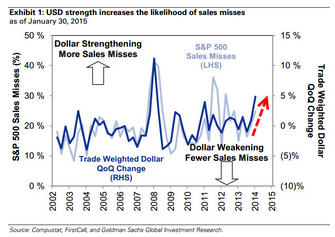

“Revenue results are correlated to dollar strengthening, which has led to weaker revenue results and lower forward guidance that incorporates the FX headwind.”

“Anecdotally, management commentary implies the dollar strengthening will lower revenue growth by 300-500 basis points. Foreign sales accounted for 33% of aggregate revenue for the S&P 500 in 2013. Based on our earnings model, a 10% strengthening of the trade-weighted dollar lowers S&P 500 2015 EPS by about $3.” To dig deeper into this, click HERE to view the entire article.

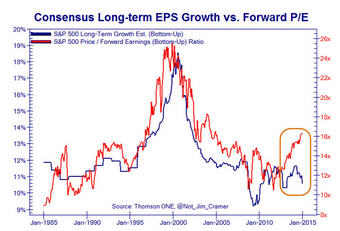

Obviously a strengthening U.S. Dollar is likely to push stocks lower based purely on earnings. However, valuations also matter and according to the same zerohedge.com article, “Consensus long-term growth estimates are slumping… which means multiple expansion is the only way to keep the dream of wealth creation alive.”

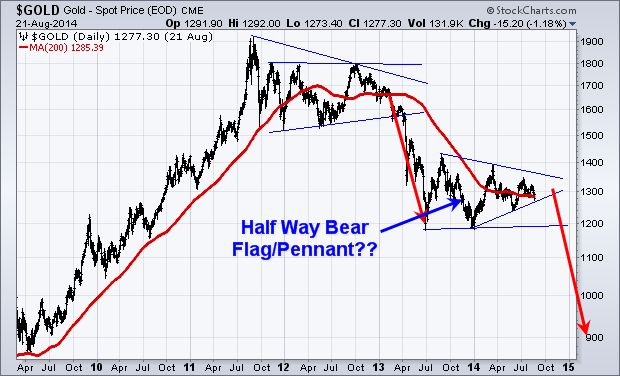

I have to say that I get a great deal of sound, independent information from zerohedge.com which I find to be very useful for formulating trades. One more interesting chart I found over the weekend in a totally different post on their blog is shown below:

So according to more than one article on zerohedge.com, the fundamental picture for earnings is being weighed down by a strong U.S. dollar. The earnings and valuation backdrop in the same article is also concerning in the intermediate to longer-term. Lastly, when looking at the correlation between the Commodity Index and the Baltic Dry Index, we see a sudden shift that places the S&P 500 Index in a major divergence compared to historic norms. Now that I have leaned heavily on zerohedge.com to handle the fundamental side of my research, it is time to dig into the derivatives side of the trade equation.

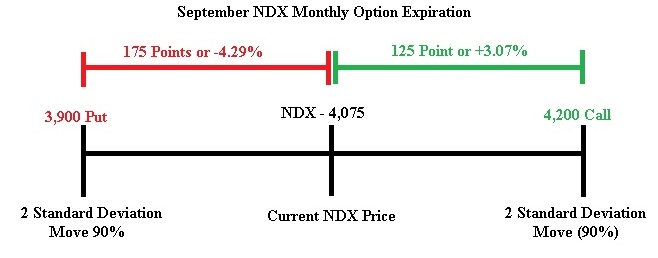

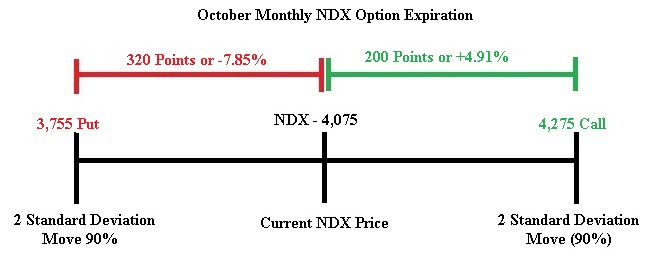

When looking at the S&P 500 Cash Index Options (SPX), another interesting observation is notable. When looking out to the June monthly expiration and Friday’s closing price in the S&P 500 Cash Index of 1,995, an interesting standard deviation skew appears. The June 1,525 Put is exactly 2 standard deviations from the current price on the downside. The June 2,200 Call is also 2 standard deviations from the current price.

This means that the market is pricing in about 205 points of upside or about 10.27% potential upside. Conversely, the two standard deviation move to the downside is roughly 400 points or about or roughly 20.04% potential downside. I would point out that the marketplace is pricing in a move of almost 2 times the severity on the downside in the S&P 500 Cash Index options. Pair this market expectation with the fundamental data discussed above, and the potential for serious downside does exist.

I want to be clear that I am already leaning short the S&P 500 Cash Index (SPX) in my portfolio as my beta weighted Delta against the S&P 500 Cash Index (SPX) is negative overall. However, I have not taken an actual short position in the S&P 500 Cash Index (SPX) or its cousin, SPY . . . at least not yet.

However, after seeing the U.S. Dollar strengthen recently I was able to enter a February call credit spread in EEM (Positive Time Decay / Profitable if EEM moves lower) for the members only portfolio. That trade will likely be closed for some strong profits in a short period of time. The option trade was taken on January 23rd for a credit of 0.37 per spread.

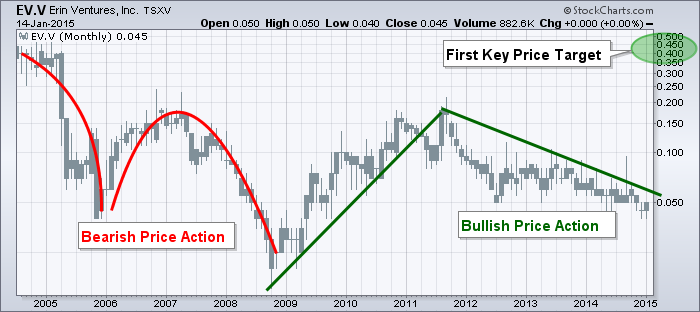

Members of our ETF trading newsletter also has a position in an emerging market fund that is setting up for potential 60% move!

The trade could have been closed on Friday for 0.06 debit per spread. The difference, representing the profit on the trade is 0.31 or $31 per spread. The maximum risk per spread was $113, so the actual return based on maximum risk was 27.43% based on Friday’s closing prices. While this is a great return, not every trade works this well and produces profit this quickly.

While I will be locking in profits in the EEM February Call Credit Spread early this coming week, I intend to take a similarly bearish trade in the S&P 500 in the near future. I may look to go out as far as March expiration to take in additional premium and to buy myself a little more room on my upside breakeven price. However, I will likely move the overall portfolio to a slightly more negative bias in the near future.

Going forward, when I highlight trades I intend on discussing the trade structure used in the future as well as an ongoing account as to which trades were profitable and which trades did not work. I am excited about the service I am offering and the new, no-nonsense pricing model. I realize newsletters are really a dying business model, but I simply have too much fun writing about my trades and running the service. Granted a little extra spending money never hurt anyone, but I am having too much fun to quit!

Happy Option Trading!

Technical Traders Options Team & Chris Vermeulen

www.thetechnicaltraders.com/options/

Back on April 9th I posted a short tutorial on

Back on April 9th I posted a short tutorial on