A very interesting setup is currently taking place in the VIX chart with our Adaptive Fibonacci Price Modeling system that has us quite concerned. The Daily VIX chart running our Fibonacci Price Modeling system, which is one of our primary price modeling tools, is suggesting upside price targets for the VIX near 110, 134 and 158. The reason these levels are extended into future price expectations is because of the recent explosion in volatility over the past 90 days.

Yet, the real concern originates from the question “what would it take for the VIX to rally to these levels and is this a real possibility in the current global markets?”. So, we attempted to answer that question by attempting to identify what it would take for the VIX to skyrocket above 110 in the near future.

Before we continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

VOLATILITY INDEX (VIX) DAILY CHART

First, pay attention to this VIX Daily chart and the targeted levels above 100. Please understand that in order for the VIX to skyrocket higher reaching levels above 100 would require another massive downside price move in the US and global markets – something unexpected and very dramatic. Is this an unrealistic expectation given the current global market environment headed into Q2 and Q3? We really don’t believe it is an unrealistic potential expectation at this point.

We’ve recently authored a series of articles suggesting the global markets are marching through a human psychological process related to the virus event (crisis). Somewhat similar to the “Grieving Process”, a crisis event prompts a similar set of human emotions ending in an angry and helpless feeling. We believe this early stage crisis event process has positioned the global markets clearly within the Denial and Stigmatization phase of the crisis event. These are the Second and Third human responses to a major crisis event (Source: www.orau.gov/).

If we are correct and the markets are reacting to the Denial and Stigmatization phases of this virus event, then the next transitional phases are Fear and Withdrawal/Hopelessness. Could this transition into a more fearful human instinct prompt a massive collapse in the US and global markets? If so, what would be the cause of this transition into fear?

We believe the transition may come from the continued economic strain that is likely to become very evident in Q2 and Q3 of 2020. Right now, the US stock market is only -10% to -15% from recent all-time highs. The reality of the virus event for traders is that this is only a minor blip in the markets so far. Yes, the markets fell much lower recently, but traders/investors have shrugged off the real risks and put their faith into the US Fed and global central banks to navigate a successful recovery. What if that doesn’t happen as we expect?

What if the real numbers for Q2 and Q3 come in dramatically lower than expected? What if global GDP contracts by -10% or -15% for the next 12+ months? What if consumers don’t return as quickly as we expect?

The Race To Cash and Bonds Again: I talked with Cory Fleck from Korelin Economics Report today. Listen to our thoughts on the race to the safe-haven assets, bonds, and cash. What about gold and gold stocks? These have been more correlated to the US markets but the charts of the major stocks and gold are still very bullish.

CLICK TO HEAR OUR CONVERSATION

WEEKLY DOW (YM) CHART

Take a look at this Weekly YM Chart and pay attention to the downward sloping price channels that help guide us to a conclusion. Additionally, the Adaptive Fibonacci Price Modeling system is showing us a new target near 12,475. If this is accurate, then a breakdown in price over the next 6+ months may push the YM to levels near 12,500 (-50% from the recent peak in April 2020). A move like this would certainly prompt a massive increase in the VIX and would frighten traders, investors, and consumers into a “helplessness” mentality. What can you do when the markets are collapsing like this except wait for the bottom.

The one thing we can be certain of is that at long as humans exist on this planet, economies will continue to function at some level. Being human in today’s world means we engage in economic activity and trade. Therefore, we believe there is a moderate risk that the US and global markets have completely misinterpreted the true price valuations and expectations based on this research. Simply put, we believe a Denial phase has taken root where investors and traders simply deny and ignore the real potential for future collapse.

I keep pounding my fists on the table hoping people can see what I am trying to warn them about, which is the next major market crash, much worse than what we saw in March. See this article and video for a super easy to understand the scenario that is playing out as we speak.

If you want to learn more about the Super-Cycles and Generational Cycles that are taking place in the markets right now, please take a minute to review our Change Your Thinking – Change Your Future book detailing our research into these super-cycles. It is almost impossible to believe that our researchers called this move back in March 2019 in our book and reports.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

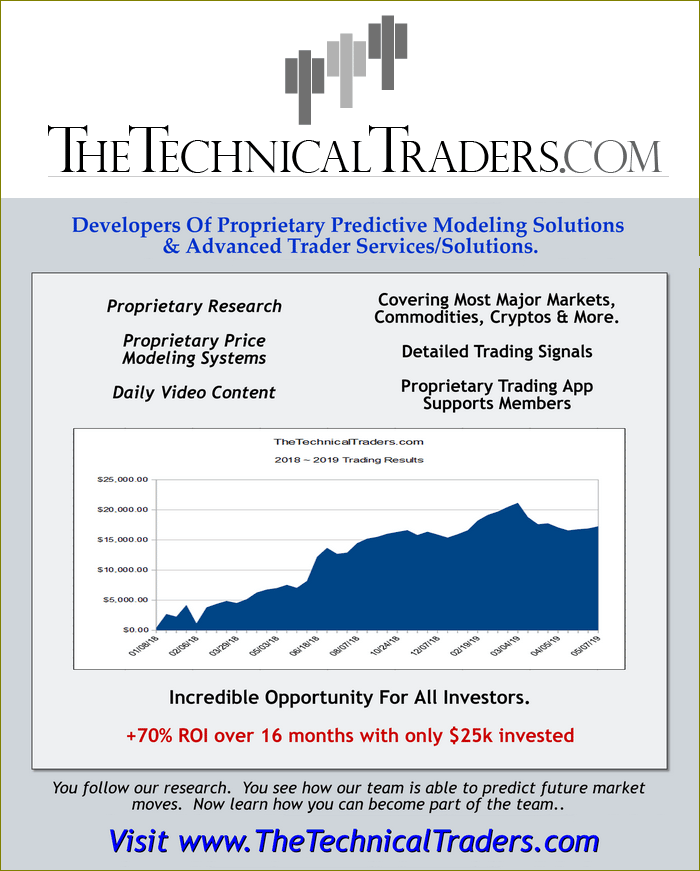

Subscribers of my ETF trading newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. Yesterday we closed out SPY ETF trade taking advantage of this bounce and our account is at another all-time high value. Exciting times for us technical traders!

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. Visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.