Algorithmic trading which is also known as automated trading has changed the way I trade and invest dramatically. As you know trading is extremely difficult to be consistently profitable in. The #1 reason individuals fail is because they struggle with their emotions and end up trading with the general market sentiment. While the herd mentality/feeling can and most of the time feels like the proper (logical) way to look at the market, trading with the “herd mentality” is the silent killer.

I am going to teach you how to read market sentiment so you can swing trade and profit consistently from emotional traders to earn 1% – 3% per month trading the SP500 index. If you want to make money, you need to trade against the herd (masses) at key support and resistance levels in the market. Plus you should have a robot (algorithmic trading system) execute these trades for you. Because, you need to completely remove your emotions from the game, and because it’s not rocket science to identify key levels where you should be entering and exiting the market with your money.

You start by looking at the market completely backwards. Focus on buying positions during heavy volume sell-offs (panic) and sell your positions during heavy volume rallies (greed). This was a very tough transition for me and I still get nervous and emotional during these times when my system enters and exits positions. This strategy feels completely wrong at the beginning but the profits speak for themselves!

One Of My Algorithmic Trading Strategies

This trading strategy is my favorite because I know the masses are panicking out of positions, sweating, and having heart burn, while my automated trading system is entering a high probability position against them. This analysis may seem basic at first glance, and that is because it is, but when you combine the analysis of each indicator explained below, you end up with a highly effective trading strategy. I took things on step further and converted into an automated trading strategy. This is one of nine automated trading strategies I use.

SP500 – 5 Minute Chart – Algorithmic Trading Strategy #1

This SP500 chart shows where a high probability short trade should be executed based on the algorithm trading indicator. It is important to know that over the past 6 years the SP500 has provided a 1.25% profit on average each time one of these extreme sentiment readings occur on the charts. While that may not sound like much of a return, know this happens several times each month and better yet, if you trade the ES mini futures, you get a lot more leverage. ES trading turns a 1.25% index gain into roughly a 10% gain based on futures margin requirements for one contract.

Anyways, the red indicator on the chart is a simple volume based indicator which measures fear and greed in the market. It is very accurate at picking market tops and bottoms. And I calculate it by taking the NYSE up volume and dividing it by the down volume. When you see this indicator start to rise it tells us the majority of traders (the herd) are buying (greedy) and we should start looking for a short entry.

Let me show you how to find the trade using the market sentiment…

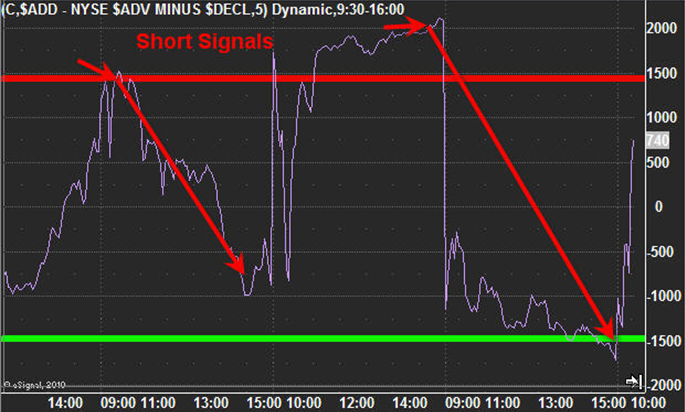

The NYSE advance/ decline line Algorithm Trading Strategy #2

How to use the NYSE advance decline indicator. It’s simple really, when there are 1500+ stocks trading up on the day then the market is getting overbought. Meaning too many stocks have moved up in a short period of time and traders will most likely start taking profits. When the other two indicators talked about in this article are confirming a short sell signal the odds highly favor a selloff in the stock market that should last 1-3 days.

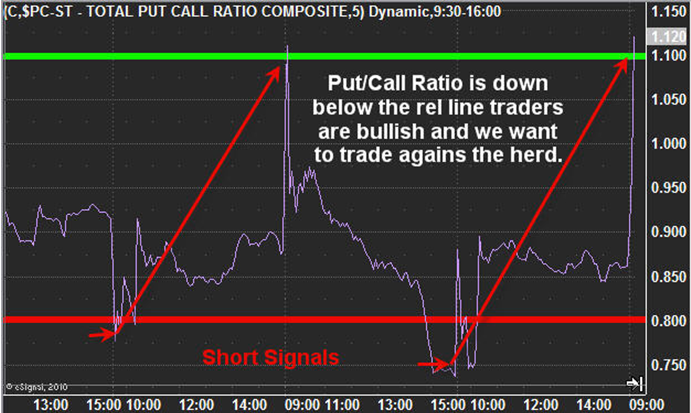

Last algorithmic trading strategy #3 is the put/call ratio

The put call trading algorithm can be a little tougher to use at times because when the market is trending down the ratio tends to fluctuate near the top. It stays near the bottom of the chart when the market is trending up but it is just the extreme spikes we are looking for.

When the broad market bounces and we see the put/call ratio drop into the lower band it’s telling me the majority of traders have finally become bullish. This tends to happen once a previous high is broken as it triggers short covering and breakout traders start to buy within a false rally during a down trending market.

Algorithmic Trading Strategies Conclusion:

If all you do is use these three indicators, focus on the 5 or 10 minute charts, trade only with trend of the daily charts 20 day moving average, and take partial profits at 1%, again at 2%, while keeping a small position open as a trend trade, you will become a more consistent trader and be able to profit from a falling stock market.

My proven algorithmic trading strategy running live but this is in a rising market… $3200 in profits made quickly, with low stress and 100% hands-free, what else can you ask for…?

It is critical that once you take partial profits at a 1% gain, you start moving your protective stop into the money to lock in a profit for the balance of the position. All three indicators need to reach the extreme levels at the same time for a trade to be triggered. Know that I have seen the market continue a trend during extremely oversold market conditions which lasted for months at times. Do not try to bet against the market just because you think its oversold and should not be shorted, just ride the trend for all its worth. Eventually your last trade will lose as the trend reverses, but wait for it, and expect to lose a trade from time to time,

Final thoughts, this strategy works just as well during a bull market. There are some minor changes required on each of the indicators which I will cover in another automated trading strategy article soon, so stay tuned for more logical trading tips.

Have My Bull & Bear Market Strategies Automatically Traded For You: www.AlgoTrades.net

Chris Vermeulen