We’ve been trying to alert all of our followers of the setup in precious metals for well over 6 months. Here is our research post from February 6, 2019 (nearly 4 months ago) that highlights our prediction of an April 21~24 momentum base and our earlier calls predicting a move above $1300, then a stall and move lower towards the base in April, then the next leg higher.

We could not have been clearer in our analysis and we predicted the bottom and rally in gold in Oct, called the top and closed our GDXJ miners position near the in February, and called for gold to bottom this April/May over 7 months in advance.

SEE GOLD PREDICTION CHART FROM OCTOBER 2018

Predicted the rally, then the correction which brings us to today

See Blog Post

P.S. If you wanna see our Proprietary Trading Tools – Click Here

Here we go again.. We’ve been nailing the Precious Metals moves for many months and we’ve heard from many of our followers and members about our research. Some of you might remember our November 24, 2018 prediction that Gold would rally above $1300, then stall and set up a “Momentum Base pattern near April 21~24, 2019“ . We find it incredible that we can make a prediction about Gold nearly 6+ months ahead of the move using our proprietary predictive modeling tools and then sit back and wait for it to happen just as we predicted.

On March 28, 2019, we posted this research article regarding the “Final Buying Opportunity for Gold”. Our researchers believe this current double-bottom setup is the last time you’ll see Gold prices below $1300 for quite some time in the future. Again, we were warning our followers that the opportunity to position their gold trades was setting up and this low price setup may be the last time we see Gold near these lows.

Our current research suggests the bottoming is over and the new price leg should begin to prompt a Gold price rally over the next 5~7+ weeks targeting a level well above $1375 initially.

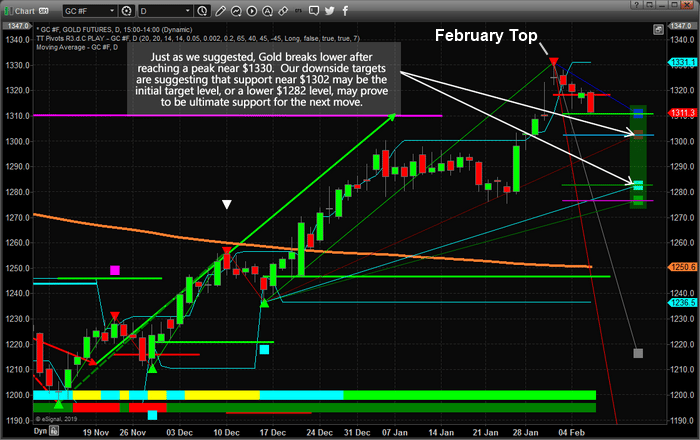

This Daily Gold chart highlights the price rotation and the Double-Bottom that has currently set up in Gold. Our proprietary Fibonacci price modeling system is suggesting an upside price leg targeting at least $1330 (on this Daily chart) will become the initial upside price leg. Remember, the Daily Fibonacci modeling system is predicting price moves over 10~30+ days.

This Weekly Gold chart is highlighting the same Fibonacci predictive price modeling system on long term data – weekly data. You can see how we’ve highlighted the price rotation peaks and valleys as well as how the Fibonacci modeling system is predicting a broader upside price move with a target near $1425 or higher.

If you pay attention to the MAGENTA price rotations we’ve highlighted throughout the initial upside price move, you’ll see there are a total of FIVE (5) rotations within that first price leg. A perfect 5 wave rotation upward. Then, the following downside price move consisted of a THREE (3) wave downside price move – resulting in a DOUBLE-BOTTOM price formation. Should this next wave, wave C, rally in equal form to Wave A, the upside price target for the move would be $1450. We believe this next price advance will be bigger than Wave A and likely result in a price target range well above $1650.

As we’ve been saying for many months, get ready and here we go. Once the protectionist moves into Cryptos have waned and traders realize the magnitude of this potential precious metals rally (as well as the fact that Cryptos will not provide the same level of protection as precious metals), the hunt for the shiny metals will be on. It would be very wise to stay well ahead of this move and prepare for this upside leg now.

We have been trying to tell you about this move for over 6+ months. We hope you’ve been paying attention and understand that even with a 4% to 8% price risk (or more) in your accumulation of Gold/Miners and precious metals positions, this trade is for the longer-term objective – not the short-term 8 to 12%. This next upside price move could target the $2100 to $2400 level if it extends into a complex advancement wave. That would mean Wave C could end well above $2100 and that Wave E could target the $5000 level or much higher.

We’ll keep you informed of this move, but you better start planning for this upside move before you miss this bottom. And just because we like to hear it – remember, we called this move back in November 2018 – over 6 months ago.

UNIQUE OPPORTUNITY: First, we typically see stocks sell-off and as the old saying goes, “Sell in May and Go Away!” which is what has been happening.

So what does this mean? It means we should start to see money flow into the safe-haven assets like the Utility sector, bonds, and most importantly precious metals. I anticipated this and our XLU utilities ETF taken with members has already hit our first profit target, and our VIX ETF trade also hit out 15% profit target and we the balance of it is still up 25% as of yesterday.

Second, my birthday was this month, and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

For May I am going to give away and ship out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have few silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Chris Vermeulen

The US Memorial Day weekend is set up to become a very interesting time for investors. The EU voting is complete and the change in EU leadership may move the markets a bit. China appears to be playing a waiting game – attempting to hold the US/Trump at bay until after the 2020 US elections. This week is certain to be very interesting for traders/investors.

The European stocks moved higher in trading on Monday as the relief from the EU election event and support for auto shares pushed the markets higher. The transition in the EU over the next few months will solidify into a political and social agenda. The EU leadership must acknowledge these future objectives of all parties in order to maintain some level of calm. It is evident that many EU nations are relatively satisfied with the current leadership while others are transitioning into more centrist leadership. The next 4+ years will be full of further transition in the EU.

China is another global issue that is relatively unsettled. We’ve been doing some research with regards to China and the potential future political and economic pathways that may become evident in the near-term future. Our biggest concern is that China has been inflating their economic levels for decades and the true scope of the Chinese economy may be much weaker than everyone expects. If our suspicions are correct and China has been inflating economic levels for many years, then the transition to a consumer/services-driven economy may be dramatically over-inflated and the US/China trade issues could be biting much harder than the Chinese want to admit.

The “Sell in May and go away” market saying may become absolute truth in 2019. Our expectations are still suggesting that an attempt at new market highs may take place before August 2019, but the current market rotation (lower) is setting up a very strong potential for further downside price action at the moment. Our proprietary Fibonacci price modeling system is suggesting the $7294 level in the NQ is key support. Below this level, the NQ could break much lower and potentially target $6850 or lower.

The YM is setting up a similar price pattern with resistance near 25,840. We believe this resistance will push prices lower as we move further into early June. The potential for some type of surprise economic data or Fed/Global market move after this weekend is somewhat higher than expected. There is a lot of shifting taking place throughout the globe and we believe this turbulence will reflect in the US market soon enough.

As of right now, our expectations are that a brief upside price rally will take place over the next 4~7+ days before a continued downside price trend may become evident. Pay attention to the news cycles for key elements that could drive the US stock market lower. We will continue to update you with regards to our proprietary research and expectations. The next 7+ days will likely be nothing but sideways price rotation within a Pennant/Flag formation.

Read our research to understand how this setup coincides with the GOLD price setup and why it is important to understand why July 2019 is so important. Please take a minute to review these recent research posts that focus more on the US Dollar and Gold, and also the July turning point for US Stocks.

4 DAYS LEFT TO GET YOUR FREE SILVER ROUNDS WITH SUBSCRIPTION!

We continue to see money flow into the safe-haven assets like the Utility sector, bonds, and most importantly precious metals. I anticipated this and our XLU utilities ETF taken with members for 4.4% already, and our VIX ETF trade we closed for a 25% last week.

For May I am going to give away and ship out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Chris Vermeulen

Our research team, at www.TheTechnicalTraders.com, have been pouring over the charts and data to identify what is likely to happen over the next 60+ days in terms of global stock market volatility vs. the US stock market expectations. Recently, we posted a research article highlighting our Adaptive Dynamic Learning (ADL) predictive modeling system on the Transportation Index (https://www.thetechnicaltraders.com/markets-rally-hard-is-the-volatility-move-over/). This research suggests we are still going to experience increased price volatility over the next 30 to 60+ days and that price rotation may become somewhat of a normal expectation throughout the rest of 2019.

We believe the key to understanding price volatility over the next 30+ days lies in understanding the potential causes of uncertainty and capital shifts that are taking place around the globe.

Next week, On May 23~26, 2019, the European Elections take place (https://www.telegraph.co.uk/politics/0/european-elections-2019-uk-vote-date-results/). This voting encompasses all 26 EU nations where all 753 European Parliament seats may come into question. The biggest issues are BREXIT and continue EU leadership and economic opportunities for members. The contentious pre and post-election rancor could drive wild price swings in the global markets over the next 10+ days.

A tough stance between both nations, the United States and China, have left trade talks completely unresolved (https://www.reuters.com/article/us-usa-trade-china/chinas-tough-trade-rhetoric-leaves-talks-with-u-s-in-limbo-idUSKCN1SN207). At this point, the currency market is attempting to absorb much of the future expectations while the US/China stock markets react to immediate news events and perceived future economic outcomes. Overall, until this issue is resolved for both nations, the news cycles will likely drive increased price volatility across the global markets.

The US 2020 Presidential Elections are ramping up with over 24 Democratic potentials attempting to unseat President Trump. The current new from DC regarding the continued DOJ investigations and political posturing regarding Barr, Nadler and a host of other DC actors is setting up for a “cliff hanger” outcome over the next 12+ months. This will likely become one of the most hotly contested US Presidential election events in decades. The news of investigations, political corruption, and a potential US political “coup” attempt is certain to keep everyone guessing over the next 2+ years.

The markets are reacting to this volatility by attempting to adjust valuations expectations and future economic outcomes in multiple forms; currency price valuations (attempting to adjust to a shifting future economic landscape as well as to attempt to mitigate risk/capital/credit issues), Stock Market price valuations (attempting to further mitigate risk/capital and credit issues, and debt rates (attempting to effectively price risk and output expectations for the future).

Here is a map of the Currency Market over the past 12 months. We can see the dramatic shift that has taken place since the price peak in February 2018.

Overall, the US Dollar has continued to strengthen over the past 12+ months and is regaining the “King Dollar” status as the global uncertainty continue to plague foreign and EU markets. We don’t expect this to change in the near future.

Our continued research into the current price rotation in the US and global markets suggest that we are going to continue to experience moderately high price volatility across all markets over the next 30 to 60+ days – possibly well into the end of 2019. As we suggested, above, the uncertainty relating to the multiple election events and global trade/geopolitical events do not present a foundation of calm and collected future guidance. The only thing we can suggest regarding these future expectations is that the US and more mature global markets should be able to navigate these uncertain times much more effectively than emerging or “at risk” foreign markets.

Below, you will see a global Heat-Map spanning one week. Traders should take special notice that certain EU countries are surviving the recent global price rotation quite well (France, Netherlands, Switzerland, Ireland, Germany, and others). We believe this is the result of the fact that these economies are rather mature and consistent in their output and expectations. Pay attention to the South American, Asian and Caribbean nations. It would appear that a fairly strong price contraction is taking place throughout much of these nations as the focus shifts towards the more mature markets.

The following One Month global Heat-Map highlights a slightly different economic picture for some nations, yet confirms the shorter-term (weekly) trends for many others. Bermuda, Cayman, Germany, and Switzerland appear to be the Bullish Leaders over the past 30 days while the rest of the globe appears to be slipping into Bearish price trends. Canada and the UK appear moderately mixed with some green showing on the heat-map – which would be expected as both of these nations are considered mature global economies with strong economic ties to the US.

We believe the next 10~30+ days are going to be filled with moderate price volatility and we expect a setup in the global markets, near the end of June 2019, where a massive price volatility explosion may take place. This could be correlated with some trade issue, some fallout of the EU elections or some breakdown in credit/debt risks taking place between now and September 2019. We’ll go into more detail in Part II of this research post.

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have a few more left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have a few more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

Many traders are watching the recent 3-day rally thinking “this is the end of the downside price move” and targeting new entry positions for the eventual upside price breakout. We’re here to warn you that our ADL predictive modeling system is suggesting we could see more volatility over the next 45+ days before a price breakout sets up.

Our Adaptive Dynamic Learning (ADL) predictive modeling system is something we like to keep away from public view for the most part. It is not something we share with the public often because it tends to show quite a bit of information about the future to skilled eyes. Today, you are going to get a glimpse of the ADL system on Weekly and Monthly TRAN charts to help you understand what to expect over the next 45+ days.

The ADL predictive modeling system is capable of learning from past price action and modeling “price DNA markers” based on a custom inference engine we created for this utility. That means it is capable of learning from any chart, any interval, any price data and any type of price activity while mapping the price data, technical data and corresponding future price activity into what we call and DNA price chain. After that mapping process is complete, we are able to ask it to show us what it has found and how current price bars align with the DNA mapping to show us what is likely for the future.

This Monthly TRAN ADL chart shows two ADL DNA Marker data points. The first data point, April 2018, consisted of 12 unique ADL price instances and suggests a moderate upside price bias may continue until near the end of July or early August 2019. August 2019 appears to be a “price anomaly” setup with a target price level near 10,000 for that month. Thus, August 2019, or any time +/- 30 days from that month, could be very volatile. The second data point originates from June 2018 and consists of 4 unique ADL price instances. The lack of ADL price instances (4 vs 12) is not as important as the predicted outcome of this DNA marker. ADL instances with small numbers of matching instances tend to be unique price data – something that is not seen in price that often and somewhat rare. This ADL data point is predicting a moderate upside price bias until June/July 2019, then the DNA marker is telling us that a downward price bias should start and that these future predictions do not have a strong probable outcome. This means August through November 2019 could be very volatile and result in unexpected price actions.

This next chart is a Weekly TRAN ADL chart that suggests 2 or 3 more weeks of moderate upside price bias before a big decline in prices headed into June 2019. If we follow the DASH lines on this chart and count the weeks going forward, it appears June 2019 will result in a moderate price decline toward the recent lows – possibly a bit lower. Then it appears the TRAN will stall near 10,200 – possibly moving a bit higher near the middle/end of July. After that, the ADL predictive modeling system is suggesting that the TRAN will break down below the 10,200 level and potentially head much lower – towards the 9,600.

The timing of this is interesting because it suggests the current US/China trade issues will not result in more price decline for the next 30+ days. Yes, we’ll like to see more price rotation, but the potential for a massive price decline over this span of time is rather muted. We may see a retest of the 10,200 level near Mid-June, but price should find support at that time and recover towards the 10,400 to 10,500 level near early July. Mid to End July looks very weak – where price may break aggressively lower, below 10,200 and attempt to target the 9,600 level.

This next chart is a Weekly TRAN chart showing our Adaptive Fibonacci price modeling system. The Fibonacci price modeling system is one of our standard analysis tools. This utility is suggesting that price weakness may set up a Descending Flag formation over the next few weeks/months. This type of pattern suggests that a breakout move will result after the apex is reached. The YELLOW trend line on this chart may become a downside price target if our ADL predictions are correct and the TRAN price breaks down toward the 9,600 level or lower.

Take another look at the end of the first, Monthly ADL chart. See those YELLOW upside ADL arrows on the right side of the chart? Those are the current ADL predictions for October, November, December 2019. This prediction suggests that the Apex Breakout move at the end of the Descending Flag formation will be an upside price breakout sometime near the end of 2019.

Be prepared for another increase in volatility in Early June and Early/Mid July. Our predictive modeling systems are suggesting a breakdown in price will happen near these dates and this downside move should result in increased VIX/Volatility when the breakdown happens.

This does not appear to be the BIG CRASH that everyone is talking about. It appears to be a normal price pattern setup as weakness settles in and the TRAN appears to retest the 10,000 level (support) with the potential of moving slightly below this level.

We’ve just highlighted what our predictive modeling system is currently proposing will happen over the next 6+ months in the TRAN. If you know anything about the TRAN, you should be able to translate this into a trading road-map for the next 6+ months in the US markets. What is the value of having something like the ADL – being able to look into the future and see what is likely to happen 4 to 6+ months into the future? Visit www.TheTechnicalTraders.com to learn how we deploy these proprietary tools for our members to help them find and execute better trades.

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 20% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have a few left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have a few more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

Chris Vermeulen. Founder of The Technical Traders joins me to share his thoughts on the recent flow of money into safe haven assets. During the selloff, yesterday in US markets money moved into bonds, gold, and back into the USD. We discuss just how long this run could last and which sectors Chris is the most bullish on.

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 3 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 3 more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

This is a delayed video sample of what I share with members to my Wealth Trading Newsletter each and every morning

before the market opens. Learn, Be Alerted, and Profit!