In our continued effort to help skilled traders/investors understand the future risks associated with geopolitical market turmoil, the EU Elections next week and the continued US/China trade war, this Part III of our Sector Rotation article will highlight certain sectors that we believe may continue to perform over the next 12 to 24+ months and help traders/investors survive any extended price volatility/rotation over that same time. Read Part I, and Part II.

Currently, the US stock market has weathered a bit of a jolt in terms of price rotation. After many stock indexes reached new all-time highs, the news of Iran Oil Sanctions, US/China trade talks failing and the political turmoil in DC as an incredible 2020 US Presidential election cycle heats up, investors are watching the markets for any signs of strength or weakness. Meanwhile, the US Dollar continues to strengthen against other global currencies in an incredible show of “King Dollar” strength and dominance. All of this plays into one of our favorite narratives that we started discussing over 30 months ago – the Global Capital Shift.

For those of you who remember our many articles about this global market phenomenon and the root causes of it, we’ll try to keep the following example/explanation of it fairly short. For those of you that are new to our research, please allow us to try to explain the Capital Shift event and why it is important to understand.

The Capital Shift started after the 2008-09 global credit market collapse. The US and many other nations created an easy money policy that was designed to spark investment and recovery across the globe. This easy money, at first, supported failing companies and governments in order to maintain social order and structure. After that process was completed, this capital went to work investing in under-valued global markets and assets. As prices continued to rise and the easy money policies became rooted into the social structure, the hunt for greater returns rotated throughout the planet – diving into undervalued markets and opportunities, often with no regard for risk.

After 2014, things began to change in the US and throughout the planet. The US entered a period of extended sideways trading that caused many investors to reconsider the “buy the dip” mentality. In 2014-15, China initiated “capital controls” in an effort to prevent outflows of capital from a newly rich population and corporate structure. Just before 2014, the Emerging Markets went through a period of pricing collapse which was associated with over-inflated expectations and $100+ oil. All of that started changing in 2014~2016 as Oil prices collapsed – taking with it the expectations and promises of many Emerging Market investors and speculators.

This shifting of capital in search of “returns with a moderate degree of risk” is what we are calling the “Capital Shift Event”. It is still taking place and it is our opinion that the US stock market will become the central focus of global capital investment over the next 4+ years. We believe the strength of the US Dollar and the strength of the US Stock Market/US Economy will drive future capital investment into US and other US Associated major markets in an attempt to avoid risks associated with the foreign market and currency market valuations. In other words, when the crap starts flying across the globe, cash will rush into the US and other safe-haven investments to protect real value.

Currently, the potential for another price decline in Crude Oil is rather strong with our research expecting a move back below $55 ppb over the next 4+ months. We believe a further economic contraction across the globe with a very strong potential for increased price volatility will drive Oil prices back below $55 with a very strong potential for prices to settle near $46~48 before the downward trend is completed.

The potential for some type of price contraction over the next 12+ months will be related to how the global and localized economic concerns play out over the next 24+ months. Yet, investors can prepare for these extended price rotations now by becoming aware of weakening price trends and the potential that certain sectors will likely be hit harder than others. For example, the most recent price weakness in the US stock market appears to be focused in certain sectors:

Technology, Semiconductors, Scientific Instruments, Financials, Asset Management, Property Management, Banking (Generally all over the US), Consumer Goods – Electronics, Airlines, Mail Order Services, Industrial Goods, Aerospace/Defense, Farming and Farming Supply, Medical Laboratories, Medical Appliances, Oil & Gas and others. This type of market contraction is fairly common in an early stage Commodity and Industrial economic slowdown.

The sectors that are improving over the past week are : Healthcare, Electric Utilities, Diversified Utilities, Gas Utilities, Consumer Personal Products, Consumer Confectioners, Cigarettes, Entertainment, Beverages and Soft Drinks, Meat Products, Specialty Eateries, REITS (almost all types), Credit Services, Telecom and Telecom/Communication Services.

All of these are protectionist rallies based on the US/China trade war and the market rotation away from Technology/manufacturing growth and into more consumer protectionist spending mode – where the consumer and larger firms focus on core items while expecting a mild recession within the economy. All of this is very common at this time within the US Presidential Election cycle. In fact, our researchers have shown that nearly 80% of the time when a major US presidential election is taking place, the US stock markets will decline within the 24 months prior to the election date.

The Monthly S&P heat map is not much different. It is still showing weakness where we expect and strength in sectors that have been somewhat dormant over the past 4+ years. The key to success for skilled traders is to be able to play this future price rotation very effectively as the different sectors continue to rotate headed into the 2020 US Presidential Elections and with all of the external foreign market factors taking place.

It is quite likely that the US Dollar will continue to push high, possibly well above $102, before finding any real resistance. It is very likely that most of the US stock market will fair quite well over the next 24+ months – yet we do expect some extended price rotation over this time and we believe Technology, Financials, Real estate, and Industrial/Consumer related stock sectors could take a hit over the next 16 to 24 months. These rotations are, again, common for this type of US Presidential Election cycle. Skilled traders are already aware of this cycle and have begun to prepare for this event to unfold. The unknowns of the current global market is China and the EU at present.

And with that last US Dollar chart, there you have it. Our three-part article about how the Global Capital Shift is about to intensify and continue to drive a US Sector rotation that many traders have failed to consider. The EU elections, the US/China trade wars, and the US Presidential Election event are all big factors in what we believe will drive in an increased level of uncertainty over the next 16~24 months. Additionally, we are very concerned that China is very close to experiencing what we are calling a “broken backbone” over the next 12+ months. We believe the pricing pressures in combination with a slowing economy and a consumer move into a protectionist stance could create a waterfall event in China/Asia.

Our advice for traders is to protect open long positions and to prepare for 16 to 36 months of “repositioning” of the global markets. The US elections are certain to drive an incredible range of future expectations throughout the world. Combine that with the EU elections, the BREXIT effort and the continued repositioning of US/China/Foreign market relations and we are setting up for a big shock-wave event in the near future.

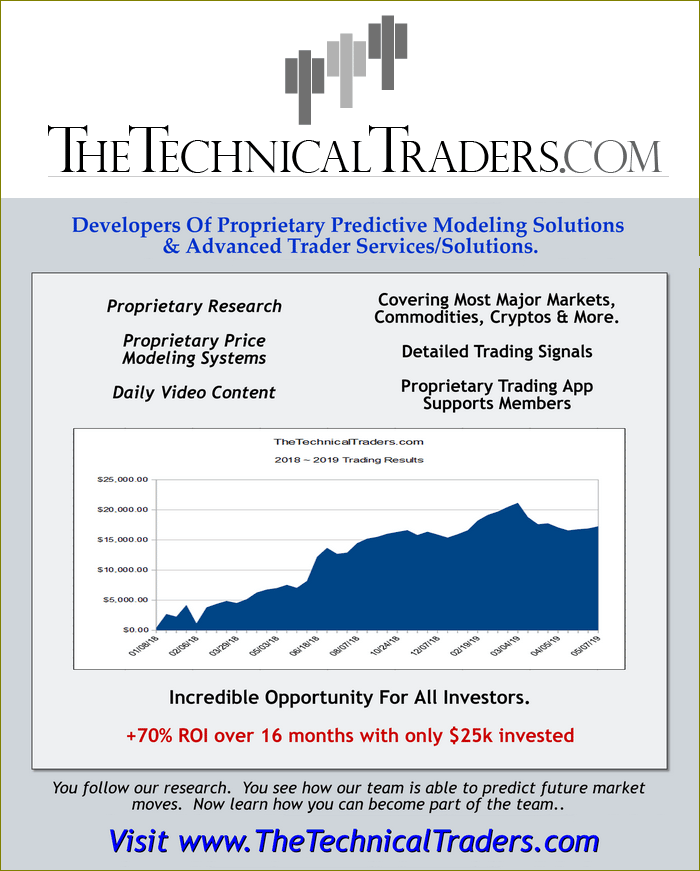

Follow our research. We’ve already mapped out the next 24 to 36 months of market price activity with our proprietary price modeling tools. We believe we know what will happen over the next 24 to 36 months, we are just waiting for the price to confirm our analysis. Visit www.TheTechnicalTraders.com to learn more.

Chris Vermeulen

Technical Traders Ltd.