Gold and silver have taken more of a back seat over the past 12 months because of their lack of performance after topping out in 2011. Since then prices have been trading sideways/lower with declining volume. The price action is actually very bullish from a technical standpoint. My chart analysis and forward looking forecasts show $3,000ish for gold and $90ish for silver in the next 18-24 months.

Now don’t get too excited yet as there is another point of view to ponder…

My non-technical outlook is more of a contrarian thought and worth thinking about as it may unfold and catch many gold bugs and investors off guard costing them a good chunk of their life savings. While I could write a detailed report with my thinking, analysis and possible outcomes I decided to keep it simple and to the point for you.

Bullish Case: Euro-land starts to crumble, stocks fall sharply sending money into gold and silver which are trading at these major support levels which in the past triggered multi month rallies.

Bearish Case: Greece, Spain and Italy worth through their issues over the next few months while metals bounce around or drift higher because of uncertainty. But once things have been sorted out and financial stability (of some sort) has been created and the END OF THE FINANCIAL COLLAPSE has been avoided money will no longer want to be in precious metals but rather move into risk-on.

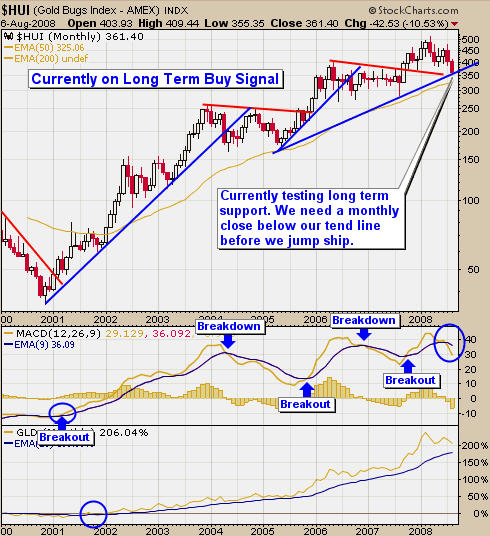

Take a look at the gold and silver charts below for an idea of what may happen and where support levels are if we do see money start to rotate out of metals in the next 3-6 months.

Over the next few months things will slowly start to unfold and shed some light on what the next big move is likely going to happen to gold and silver.

The price movements we have seen for both gold and silver indicate were are just warming up for something really big to happen. It could be a massive parabolic rally to ridiculous new highs in 2012/2013 or it could be a huge unwinding of the safe havens as countries sort out their issues and the big money starts moving out of metals and into currencies and stocks.

Only time will tell and that is why I analyze the market multiple times per week to stay on top of both long term and short term trends. So if you want to keep up with current trends and trades for gold, silver, oil, bonds and the stocks market checkout TGAOG at: http://www.thegoldandoilguy.com/free-preview.php

Chris Vermeulen