Prices continue to churn as traders and investors try to figure if they want their hard earned dollar in cash or investments. The market is very jittery simply because no one wants to get caught on the wrong side of the market if it makes another 30-40% move, which is why we are seeing money rotate in and out each with very little commitment and follow through. Until a major trend looks to be in place most investors will not me holding many positions over night or through the weekend.

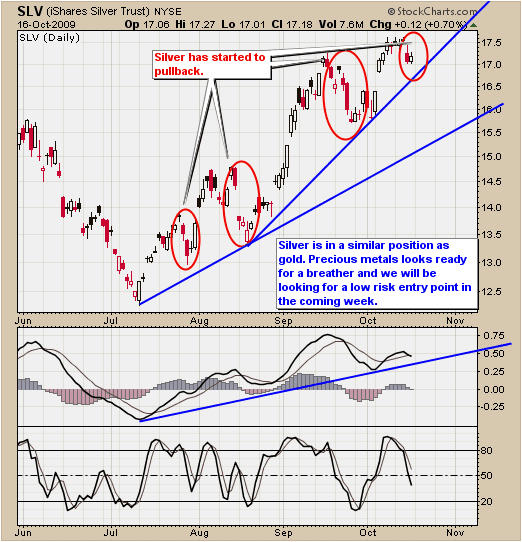

Here are a couple charts on what I think is most likely to happen in gold and the sp500.

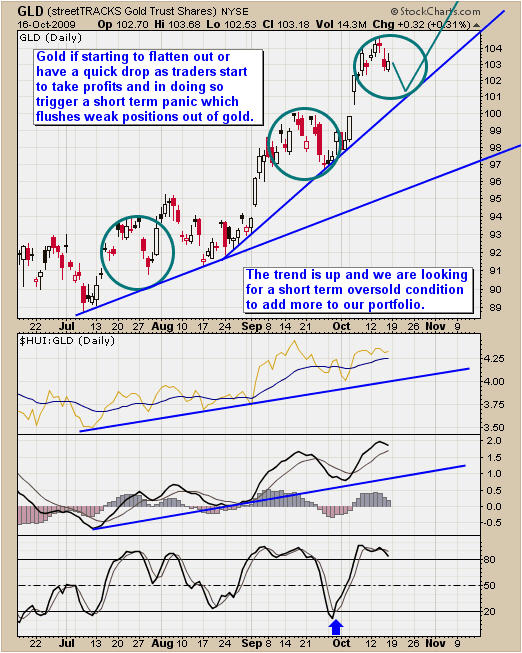

GLD – Gold ETF Daily Chart

Last week we saw gold move higher by 1% but I cannot help but think a sharp sell off is only days away from being triggered. Either we get a another pop into resistance which would eventually trigger a wave of sellers and cause a sharp drop or the price of gold will drift lower to eventually break a key support level and trigger stop orders. Once the stops start to get triggered I would expect follow through selling for a couple days which will pull the price of GLD back down to the $113-116 area.

Also there is a possible head and shoulders pattern forming on this chart which is not picture perfect one but, it’s important to be aware as a neckline break could trigger massive selling and pull GLD down to the $100 area. But that would not unfold for several weeks if not months.

SPY – SP500 ETF

SP500 broke down from the support trendline two week ago and has since been trying to bounce. Last week we did see a two day pop but was given back Thursday. As you can see there is a possible mini head & shoulders pattern forming and the current price is testing the neckline. A breakdown below this should trigger a move to the $102 level.

Weekend Trading Conclusion:

In short, the market is trading at a key support level and this week should be exciting. Looking at several large cap stocks I am seeing bear flags on a large percentage of charts. Seeing these forming makes me think lower prices are just around the corner.

It looks like low risk trading setups are about to start popping up across the board and if we get a powerful trend going into the year end there will be some good money made for those on the proper side.

Receive My Free Weekly Trend Trading Reports and Market Updates at: www.TheGoldAndOilGuy.com

Chris Vermeulen