The past three weeks have been filled with intense drama, incredible highs and lows, political battles that continue to this day, and millions of questions from people throughout the world. Throughout this COVID-19 virus event and the collapse of the US and global markets, one continued belief has prevailed – the US Fed will attempt to rescue the global markets (again).

Late last week, President Trump announced a task force to evaluate how and when to reopen the US economy and more than US nine states have already committed to a staged reopening process. COVID-19 virus being what it is, the US is going to attempt to lead the way forward. This means every resource and every effort will be taken to engage in a proper process to protect our future while battling this virus outbreak.

This was also a pivotal week for the US Stock market. With the US Fed in buying mode attempting to counter the recent weakness in the markets, literally trillions of dollars have poured into the US stock market over the past 5+ days. The Dow Jones Industrial Average rallied 532 points (+2.2%). The NASDAQ rallied 581.50 points (+7.06%). The S&P 500 rallied 89.25 (+3.2%). Obviously, capital is pouring into the NASDAQ faster than the other major indexes and this suggests investors believe in the earnings and future capabilities of technology companies over more traditional market segments.

Continued global economic weakness and shuttered US states will have a chilling result on Q2 outcomes and revenue growth. We continue to believe Q2 and Q3 of 2020 will be much weaker than investors are expecting and we believe the US Fed has lulled many investors into believing a “deep V bottom” is the most likely outcome. Over time, we believe the loss of 20+ million working Americans and the destruction of the shuttered global economy will translate into much weaker global market price levels.

Before we continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

NASDAQ (NQ) WEEKLY CHART

This NQ weekly chart highlights the real potential for downside risks. The appreciation in price from the 2016 levels are a direct result of investor anticipation of growth after the 2016 election. What’s changed is that a major risk to the markets has unraveled more than all the growth we’ve accumulated over the past 2+ years. Investors should stop to consider the real economic outcome over the next 2+ years before jumping into the Fed-backed Twilight Zone.

As the total scope of the global economic environment continues to shift, it does make sense that certain technology companies may benefit from any type of extended virus event. Gaming companies, technology suppliers and resellers, certain software companies and a host of streaming and content firms may gain users and incomes over the next 12+ months. Yet, we continue to believe the COVID-19 virus event may continue to present risks in the markets going forward.

The NY Federal Reserve issues a GDP Nowcast which attempts to translate forward economic GDP outcomes in near-real-time. The current level for Q1 2020 GDP is -0.4% and -7.9% for Q2 2020. This suggests the second, and possibly third, quarters could be substantially weaker overall than what we’ve just experienced over the past 50+ days. Even though the stock markets began to collapse on February 25, 2020 – we really didn’t begin to understand the total scope of the economic contraction until nearly the middle of March (very late in Q1). Q2 may reflect the complete global economic burden of this virus event and we believe investors are failing to comprehend the total scope of this risk at the moment and how it relates to future earning capabilities.

Weakness in Q2 and possibly Q3 earnings for 2020 could have a shock-wave across many sectors of the US and global markets which we are somewhat blindly ignoring. Asset values, belief in a “V” type bottom setup, lack of disruption for state and local governments and others seem to continue to be the prevailing attitude. With the US Fed to the rescue, somehow investors seem to believe the recovery process will only take a few weeks or a few months.

We found this information very interesting in terms of how local governments generate revenues and how the virus event may present a very real 20 to 40% revenue contraction for state and local governments over the next 24+ months. Based on this data, nearly 40 to 50% of annual revenue to state and local governments may be at risk. When we consider the 20+ million people in the US that have recently filed for unemployment (nearly 6% of the total US population and 8% of the total working population), we can’t expect a stellar economic output.

S&P 500 (ES) MONTHLY CHART

This ES Monthly chart highlights our expectation that the US Stock market will attempt to establish a deeper bottom in price that may take the form of a FLAG formation setup. We don’t believe the continued disruption to the global markets will do anything to support the past 3+ week recovery in the US markets. Global investors will likely end up backing the US as the leader in this recovery, yet we believe the actual bottom in the markets will take place over the next 12+ months and likely complete just before the November 2020 elections.

CONCLUDING THOUGHTS:

Our proprietary modeling systems have reflected the recent strength in the US stock market adequately – yet they have failed to result in any changes regarding allocation into the markets. For right now, everything stays the same as it was. We do believe the Fed’s buying will potentially prompt a “false trigger” if the rally continues. We will assess the trigger when and if it happens in the near future.

Until we get a more accurate understanding of the risks, we feel it is much safer to assume the worst-case scenario going forward. There is simply no way to paint a positive picture when people throughout the globe are losing their jobs, incomes, and all sense of normalcy. The reality is that this disruption in the global banking and financial sector is certainly a big one that could last well into summer. If you read this article or watch the video you will understand the magnitude of this market top that looks to be forming.

As of right now, skilled investors are preparing for a potentially deeper price bottom and watching what is happening in the markets with interest – waiting for the right trigger to jump on the next big trend.

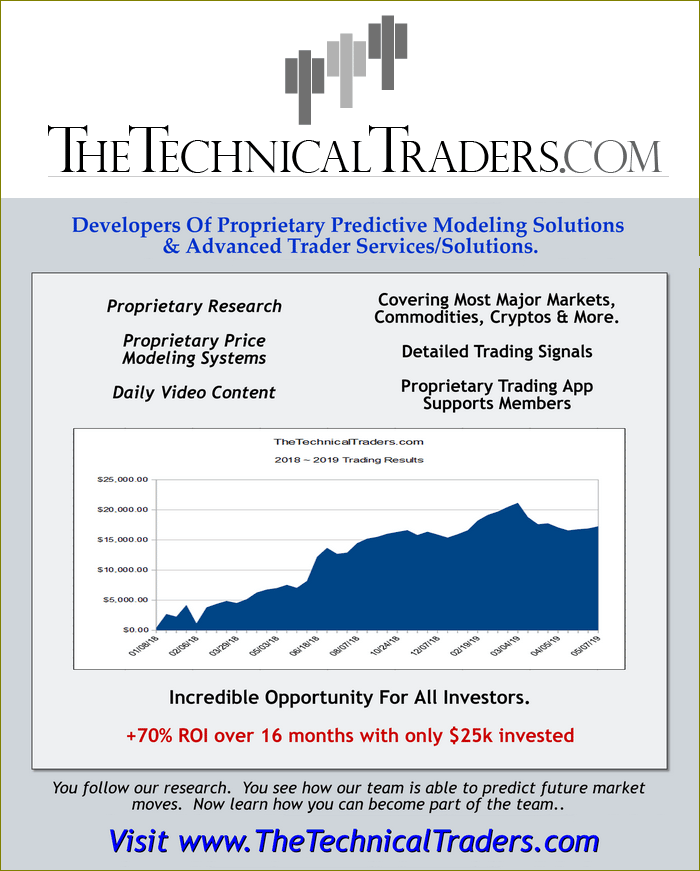

I have to toot my own horn here a little because subscribers and I had our trading accounts close at a new high watermark for our accounts. We not only exited the equities market as it started to roll over, but we profited from the sell-off in a very controlled way, and yesterday we locked in more profits with our SPY ETF trade on this bounce.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. Visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.