Active Trading Partners launched its brand new trading and investing commentary service on July 15th, 2009. In the short seven weeks since we launched, ATP has produced numerous stocks that have gained, 30, 40, 50, 60, and even 100%. Below are some excerpts from actual ATP research postings on our new service for Partners/Members. Most recently, we recommended JAZZ last Tuesday, 9/1/09 and it has risen as much as 63% in one week.

Are you getting quality advice, market updates, regular follow ups on your positions, and booking gains on an 80-90% success rate? If not, perhaps you should try a subscription to ActiveTradingPartners.com, where we are unmatched in our returns to partners.

We are limited to 200 subscribers and are nearly filled now, so act now. For $249.00 per month you get 8-10 new positions alerted per month, or about $25.00 per alert. With average historical returns of over 20% per recommendation. $10,000 put into each of our positions since the launch would have returned over 100 fold your $249.00 investment per month.

Samples below:

August 4th, 2009- LRR.TO/LRLMF $1.66

…Linear Gold is a micro cap gold stock, and I usually will hesitate to put these on the ATP service, but this one looks like a great value going forward, and I like the chart set up here as well…Shares outstanding are 34 million. That’s a market cap of 58 million Canadian, or less than 2x future projected net cash flows. They have 24 million in the bank, 0 debt currently, and multiple drill projects. They have leverage later on to future gold price increases, and position to acquire other projects/exploration plays. I’m not seeing a lot of downside here.

Results: Linear Gold ran to $2.28 17 days later for a 37% gain.

August 14th- CRXX- $1.05

… the “Saucer” chart is bullish because of the general sideways movement over a long period of time. This is a transfer of shareholders from old to new, re-setting a large base for the stock. A break over $1.10 could trigger a run back to $1.34 a recent spike high on good news several weeks ago. Also, there is a huge “gap” at $3.00 a share above. This means there is an air pocket where technically there are no sellers until $3.00. The only sellers will be the traders who bought recently, or buy near term. To say that I am excited by the long term prospects of this merger would be an understatement.

Results: CRXX ran to $1.34 within a few days for a 25% gain. It has since risen as high as $1.92 on September 1st, for a 75% gain in 3 weeks for ATP.

August 18th- VICL- $3.35

…with Federated Kauffman paying $3.63 a share just a few weeks ago for 3 million shares, they brought their total to 5.4 million shares. The stock has drifted down and volume has dropped from a 90 day average of over 1 million to just 350,000 or so a day lately. This normally precedes a shift in sentiment and price movement, quite simply the crowd has moved on.

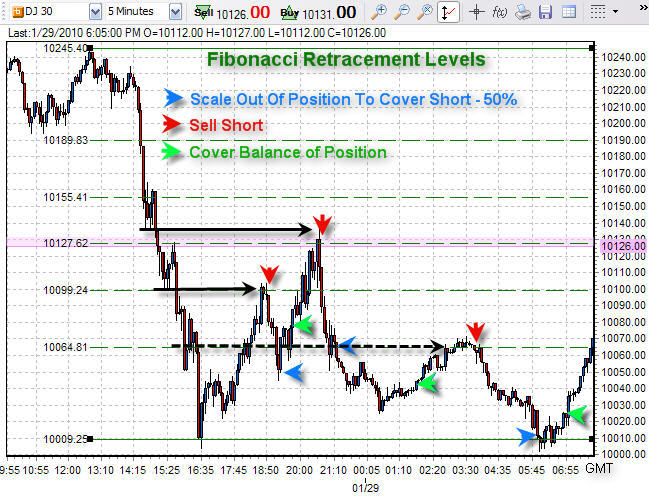

We have an ATP proprietary “Fibonacci Intersection” on Aug 17th, and to ATP it means the stock bottoms around that time and it’s time to start accumulating positions… A break over $3.40 will probably start a new bull trend in the stock.

Results: On September 3rd, 16 days later, VICL hit $5.40 for a 61% gain

August 20th- SPPI- $6.27

SPPI- …When the stock hit 6.05 earlier this week, it was at the bottom of proprietary indicators I have developed as reliable for pivots. I mentioned earlier this week that I had picked some up at 6.12 and 6.15. This afternoon I was an aggressive buyer at a 6.27 average per share and building a position… The chart appears to be very bullish and very oversold at the same time. If I was to hazard a guess, I would see a move up to 6.80-6.90 again, then a pullback, and then a breakout over 7 with a run.

Results: On September 4th, SPPI hit $9.00 a share for a 43% gain in two weeks.

September 1st- JAZZ $7.29

The stock closed 8/31/09 at $7.29 a share and has been in a general trading range for about 5 weeks now. We also have a 5 day reverse head and shoulder pattern, often a leading indicator of a move up. ATP research would not be surprised to see a move towards $10.00 per share over the intermediate time period.

Results: On September 4th, Jazz soared over $10.00 per share for a 40% plus gain in 3 trading days for ATP

September 2nd- RINO $12.60

…accumulating a position in RINO here in the 12.50-12.90 window. The volume has completely dried up on the stock after the recent run from mid 10.70 to 14.88. The pullback is a typical “B Wave” pullback in an “A-B-C’ move to the upside. This actually retraced a perfect Fibonacci 61% retracement of the recent swing move up… The valuation remains very cheap, the company is very under-followed.

Results: Stock closed at $14.27 the next day as Rodman and Renshaw initiated coverage with a $22 target. 13% return in 24 hours.

Please visit our website for more information: www.ActiveTradingPartners.com

Chris Vermeulen