PART II – Global Economic Perceptions Are Shifting

The continued efforts of our research team to identify and quantify the possibility that the capital shift which has taken place over the past 18+ months may be shifting to other assets is in the interest of all global investors. Is there a new, more opportunistic investment that will take away from the capital that has been rushing into the US equity markets over the past 2+ years or is the capital shift towards the US equity markets still intact? These are the questions before us and these are the questions that will determine if the US equity markets continue to rally or continue to top out.

In part one of this research article, we began to explore the aspects of our research that we believe are key to understanding the future of the global capital shift phenomenon. In short, the capital shift is the movement of investment capital from one asset to another asset (from country to country, from one form to another or from one asset class to another) in an attempt to seek out and secure the best, safest and most secure ROI on the planet. We believe this process has been a driving force behind much of the global markets success or malaise over the past 4+ years (actually starting near 2013 when wealth in China and capital controls forced investors to seek outside investment sources).

Additionally, in part one of this research article, we highlighted the traditional range channels of the US equity market and how these ranges have played an important role in identifying price support. Currently, the US market is sitting at the middle support level of historical ranges after retracing from recent highs. This is far from the “crash moment” that many are predicting. The reality is that this is more of a reversion to support in a strongly upward sloping price channel.

Let’s start out by asking the question “what will happen to Asia/China over the next 2+ years and what will happen with the capital from Asian investors?” Should we believe that China/Asia capital markets are healthy and robust for sufficient ROI in current form or are these investors seeking outside sources for healthier and safer ROI solutions for their capital? And what should we expect over the next 18~24+ months beginning in early 2019?

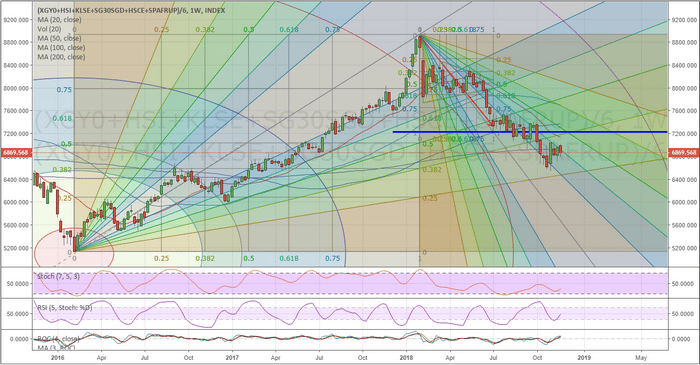

Our Custom China/Asia Index has clearly shown that prices have reflected a downward trend since the top in early 2018. This price decline has already breached the 50% Fibonacci retracement level and appear to be attempting a deeper price move lower. We believe the banking/credit/expansion issues in Asia/China are related to this capital contraction and won’t abate until the majority of these issues are resolved. In other words, there is far too much uncertainty in this area of the investment world to support a change in investor sentiment. Yes, everyone wants to see Asia/China settle these economic issues and become poised for a stronger growth model going forward, but everyone is also waiting for the next shoe to drop to detail these expectations. Housing, Trade, Credit Markets, Banking, Global Objectives, Regional Issues, Manufacturing?? Pick one and wait a few months for some news. At this point, there is so much news originating from China/Asia that is pointing to a broad market correction that we are simply waiting for the next news item to hit.

The One Belt, One Road project is another concerning aspect to what China/Asia is capable of achieving. This project is incredibly diverse – spanning dozens of nations/countries. The reality of this project is that uncertainty abounds from all angles when one considers the routs this project is taking and the global uncertainties that originate from many of the areas on these routes. Tehran, Kenya, Pakistan, Sri Lanka, Kuala Lumpur, Jakarta?? Sure, the land and sea transport solutions offer a very interesting and dynamic shift for economic growth, but this is all based on the assumption that wars, graft, politics and local/regional tensions don’t flame up to halt or block any of these routes and the future success of this project.

Already, Malaysia has terminated multiple projects related to the One Belt, One Road objective because of corruption and fraud against the Malaysian people. We are reading news stories of Pakistan and other nations questioning the deals made with China in support of this project. In our opinion, the land routes are much more fragile than the sea routes. Ships can change course and head to another port if needed. Train tracks are not easily relocated and shifted around to address regional issues.

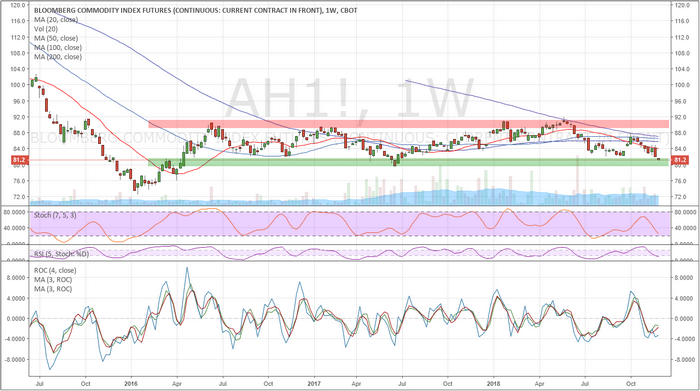

Additionally, the global commodities pricing index (from Bloomberg) is suggesting that global commodities have reached a peak and are declining. This puts pricing pressures on larger global projects like the One Belt, One Road project because profits from mining or manufacturing raw commodities and secondary commodity products are dramatically decreased. This would also suggest that suppliers and manufacturers may be experiencing an economic stall in terms of growth expectations over the next few years. If the commodities futures prices are declining, then global investors are not seeing any aspect of the global markets that would relate to higher demand, manufacturing or increased general consumption/use of global commodities.

Watch Crude Oil for signs of life in the economy. The price of Oil is often a very good gauge of economic activity and expectations in terms of freight, shipping, consumer activities and more. Oil has seen a very dramatic selloff over the past 2 months and is nearing levels that should be concerning for producers. Oil price levels below $40 ppb could be a game changer for much of the Arab world.

Our conclusion is that until global investors see the true opportunity for Asia/China and see real strength in the global commodities markets, risks continue to outweigh opportunities in much of Asia/China. Therefore, we believe the capital shift phenomenon originating from this region will continue to source more suitable returns in other global investments. Should the commodity index break down or the Chinese/Asian markets collapse further, we believe the push for outside safety will increase. This may be likely near the start of 2019.

Want to know what our predictive modeling systems are suggesting will happen in 2019 and beyond? Are you searching for a dedicated team of researchers that can help you understand where opportunities are and how to find great trades? Take a minute to visit www.TheTechnicalTraders.com to learn how we can assist you and help you find greater success. Want to see how we’ve been calling the markets, visit www.TheTechnicalTraders.com/FreeResearch/ to review all of our public research posts. 2019 and 2020 are setting up to be incredible opportunities for investors – get ready for some incredible success with these bigger price swings playing out.

Chris Vermeulen