Indexes continue to sputter on news out of Washington

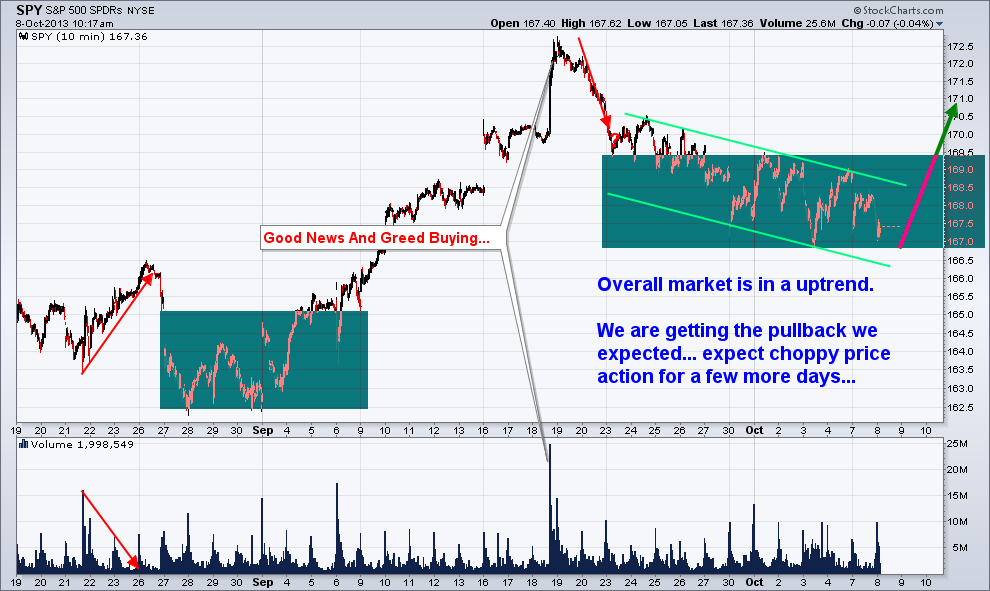

While the indexes continue to sputter on news out of Washington, we continue to focus on the charts and trade with the trend and what we see.

Understandably, several concerned subscribers have e-mailed me to get my thoughts on how we would handle such news.

As usual, the media is playing with human emotions – Fear. As talked about before, fear in my opinion the most powerful emotion and force in the financial market. So when true fear hits the country it will be clear to see, but right now, investors are in no rush to sell their positions in stocks just yet.

If our leaders fail to come to some agreement in the next couple weeks the question many want to know is

How Will We Trade This Event/News?

The answer: we ignore it. Though we could reduce position sizes to be safe when the time comes on Oct 17th.

During most bull markets, there is typically a “wall of worry” to traders and investors climb. The details are different every time, but there are usually one or two major “risk factors” that investors worry about when the broad market is trending higher.

Traders and investors who focus on doom and gloom headlines are more than likely to be shaken out of their long positions…especially those who lack conviction in their trading system.

Conversely, I focus on individual price and volume action of leading sectors and ETFs.

Holding long positions through market corrections is never easy, but it is NOT our job to decide when a trend is over.

If we approach trading with a clear and objective mindset, the stock market will always tell us what to do, based on the price, cycles and volume action. If our ETF positions sell off to trigger our protective stops, we will simply be forced into 100% cash position.

The beauty of such a rule-based trading is that it removes some human emotion and guesswork from trading.

This increases our long-term trading success, and the added benefit of being calmer and stress-free, regardless of what is happening in the stock market.

Trading Plans…

If you are new to swing trading, or have had little success in the past with trading, it is a great idea to get in the habit of planning your trades (trading rules) and trading your plan.

You must continually try to identify all potential outcomes before entering a trade.

If you do, then you should not be surprised when price moves because you realize that anything is possible, and you have already accounted for it and used proper position management to protect capital and lock in partial gains.

Trading with rules allows you to prepare and worry before the trade takes place, so that you can focus on executing the plan when the time comes.

Above all, focus on the price, momentum and volume action, rather than the amount of profit or loss a trade is showing in your account.

If you focus on proven trading rules and execution, consistent trading profits will eventually and inevitably follow.

Are we right or wrong to focus on price and volume action, rather than news? See my stockcharts list here for info on How Price Is The Only Thing That Pays!