End of Week Market Report

Its been a volatile week with last Friday kickstarting things with both volatility and the correction in the stock market we have been expecting.

On August 31st my trading partner posted an update to TheMarketTrendForecast.com members with his 2100 downside target for SP500. This week the SPX hit 2100 perfectly and has since bounced back up. This move happened quicker than he anticipated but the level was reached none the less. This weekend he will work on the new forecast for those members and it will provide us with more insight on the market direction next week.

Also, in the Aug 31st update, he updated the gold price forecast with is starting wave 3 of 3. Gold bounced strongly off our technical and EW support level just as expected. Since then, gold has faded back down in a bullish fashion with broad market selling pressure this week. He does expect higher prices in the near term for gold which could provide traders with another NUGT trade.

At this point in time, stock picks are tough as the market has been trading in a VERY tight range for many weeks with low volatility with the exception of the last 5 trading sessions. This just may be the bottom and the starting point of another run higher with the SPX meaning some new explosive stock trades like VUZI.

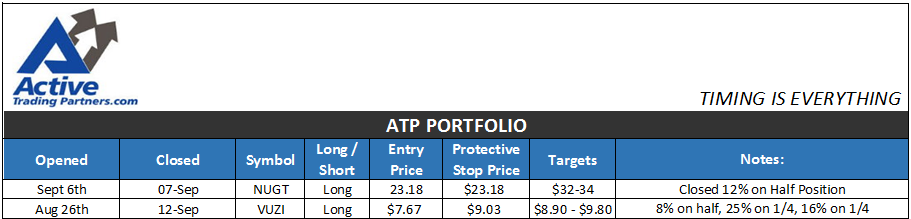

Take a look at the last two trades he gave subscribers of ActiveTradingPartners.com service:

If the stock market starts to rally he will focus on new long positions, but if things roll over and breakdown more, then inverse ETF and short trades will be more the focus.

Chris Vermeulen