Chris sits down with David Lin from Kitco News to discuss the recent runs in the different stock market sectors and the largest upside potential in 2022.

Spend a bit of time with Chris and David as they discuss market strategy. Learn whether:

- buying and holding the dips is a good idea.

- buying into fear or selling during euphoria is as hard as it sounds.

- altering your perspective will help you become a better trader/investor.

- adhering to your strategy rules will help or hinder your end results.

STOCK MARKET SECTOR ROTATION

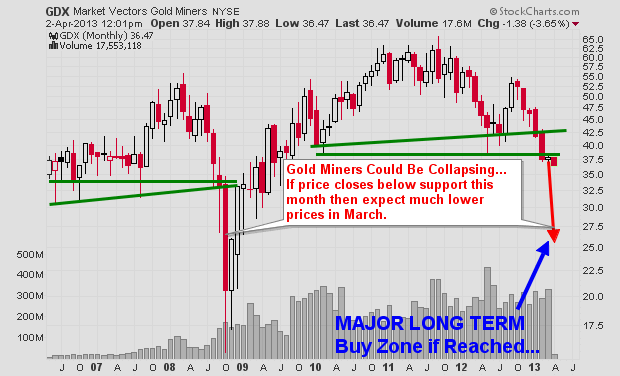

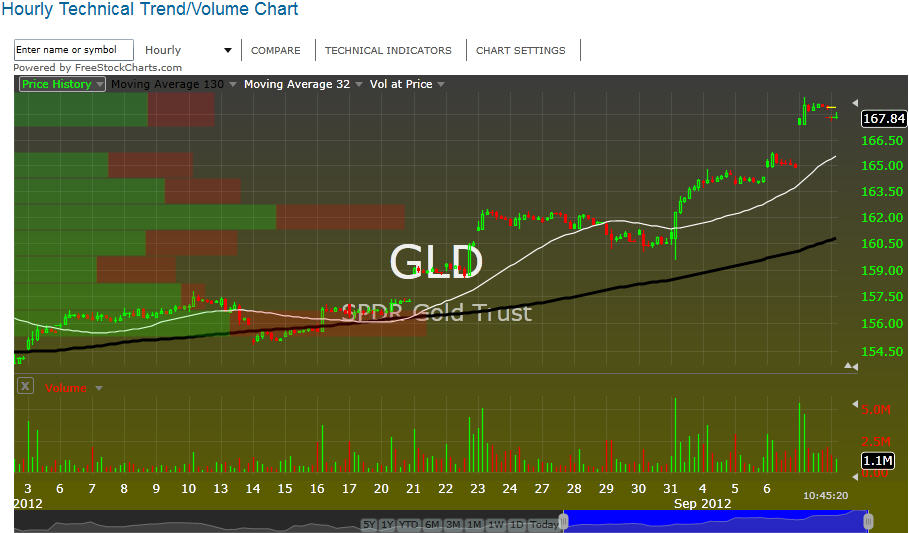

The overall feeling Chris Vermeulen has regarding the stock market is that the energy sector may be losing steam while technology, gold, silver and their miners are beginning to draw attention and investment. The economic concerns facing China and the US, in particular, are creating a situation where the stock market and gold are climbing in value at the same time.

“Stock market levels,” he says, “are determined by how we get to the lofty levels”. Parabolic moves to the upside are more likely to crash back down to earth than they are to continue their flight. If the rally takes longer and moves slower, it is more likely to chop around and then stabilize. This can offer a stronger position from which an uptrend can begin.