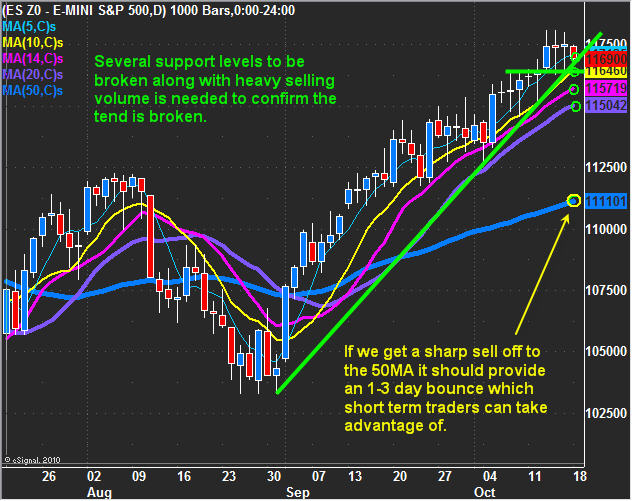

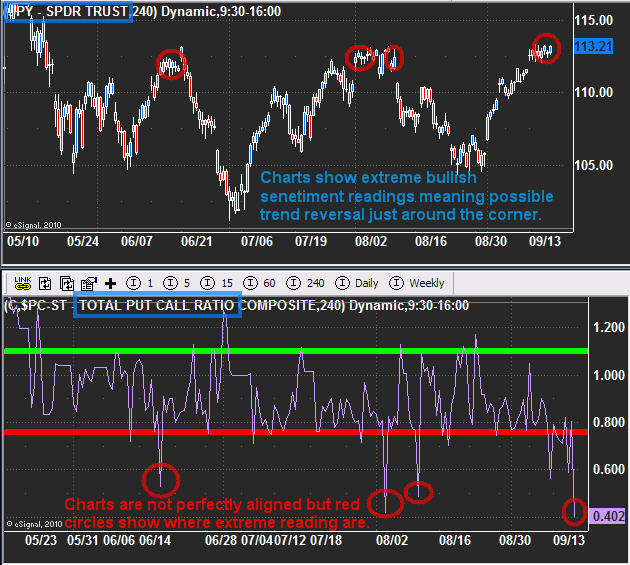

The broad markets along with metals have been on fire but in the last two weeks we have seen the sentiment become stronger. The extreme bullishness we are seeing has made it difficult for low risk swing traders to get in on the action simply because there have not been many sizable pullbacks. Instead the prices have been inching their way higher with very minor pullbacks before surging again.

The only way to take advantage of this type of price action in order to keep risk low is to take small positions when the market drops to the 5, 10 or 14 moving averages with a mental stop to exit the position if the market closes below the 14ma. Any position take up here should be small because the market is in runaway mode, meaning everyone is buying on the smallest of dips. The largest moves tend to be near the end of a trend which is why I feel this market could keep running for a few more weeks before taking a sharp plunge.

Natural Gas

If you have been reading my work over the past year you should know I don’t like natural gas. More people have lost money trying to play natural gas than any other investment vehicle out there which is why I don’t cover it very often. Many of you have been asking about Natural Gas (UNG) so here are my thoughts on it.

UNG has been in a down trend for several years and the only trades should be short positions at this time. The argument from some is that it’s undervalued and with winter just around the corner prices should go up. It’s a valid argument but price action is what makes traders money, not fundamentals.

The daily chart of Nat Gas below shows what I feel is about to happen. Remember, UNG is a terrible fund to be buying. Unless natural gas is moving strongly in your favor, this fund continually loses value simply because of the way its created.

Looking at the actual natural gas commodity chart is a different story… The trend is still down, but it does look as though it’s trying to form a base when looking at a 3 year weekly chart. That being said, there is still a very good chance we see gas test near the $3 level before starting a new trend so trying to pick a bottom here is not something I would be doing.

Trading Conclusion:

In short, the equities market is still in a strong uptrend. I’m not comfortable taking any large positions at this stage of the game but if we get a setup I will not hesitate to enter with a little money.

As for natural gas… trying to pick a bottom is deadly in a down trend as bounces tend to be short lived or flat.

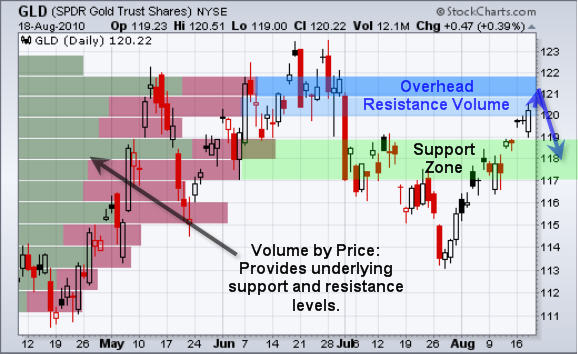

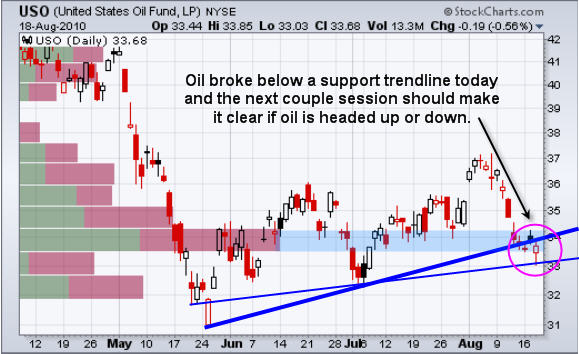

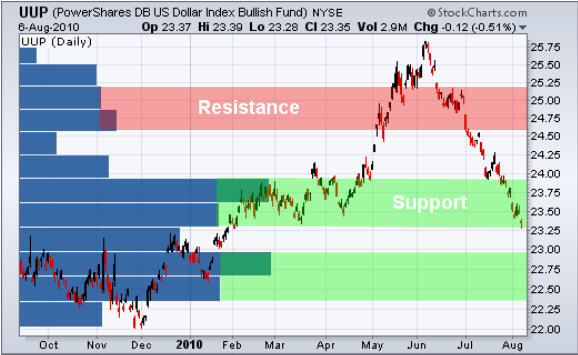

I will cover the dollar, gold, oil and the market internals in the member’s pre-market morning video…

Happy Trading

Chris Vermeulen

www.TheGoldAndOilGuy.com