March 13 2010

Last weeks price action unfolded just as we expected. Money poured into stocks with the focus being on small cap, banks and technology stocks. The fact that these sectors are showing strength while utilities, health care and consumer staples lag is a good sign that investors are once again taking risks in the market.

Because investors and traders are bullish on the stock market again the money flow into the safe havens like precious metals and energy has decreased. I believe this is the reason stocks moved up last week while precious metals drifted lower.

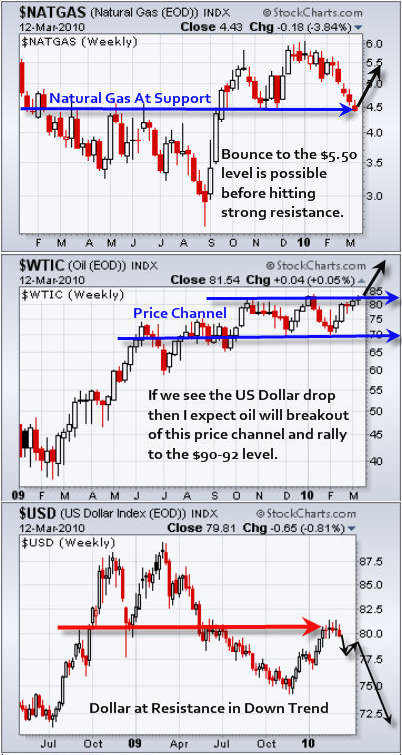

Below are weekly charts (Natural Gas, Crude Oil and the Dollar) showing what I think is most likely to happen in the next few weeks and what should fuel the fire.

Natural Gas – Weekly Chart

Natural has been out of favor for the past 3 months with most of the selling happening recently as seen on the chart. In my opinion natural gas is over sold and about ready for a bounce.

The price of NG is now trading at a key support level but until the selling momentum stops and reverses back up I would steer clear of this commodity play. Natural gas is known for taking peoples money time and time again so trade this commodity very carefully.

Crude Oil – Weekly Chart

Crude oil has been trading in a channel for several months and is now testing the upper level. If we see the US Dollar drop in the coming weeks then I expect oil to surge higher along with natural gas. If oil breaks out then I expect to see the $90 level reached within a month.

US Dollar Index – Daily Chart

The US Dollar has put in a very nice bounce/rally since the low in November 2009. Last month the dollar finally reached a key resistance level of 81. I have been talking about this major resistance level since January as the Dollar would find it difficult to break above this level.

There is a strong chance we could see 78 reached which is the measured move down. If we get follow through selling next week then I would expect 78 to be reached within 1-2 weeks and over the next few months we could very well test the 2008 low of 72.50.

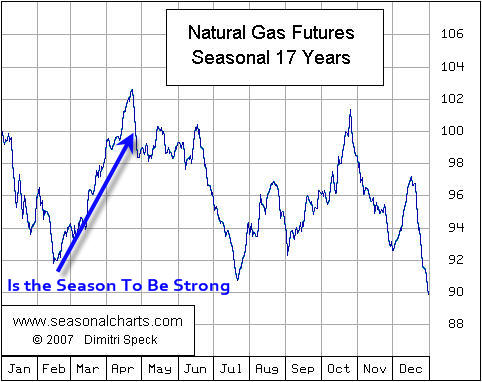

Natural Gas – It’s the Season

Natural gas’ seasonal price action shows that the price tends to strengthen between February and April. So with NG at support and we are in March you can guess what I’m thinking… higher prices are where the odds are pointing.

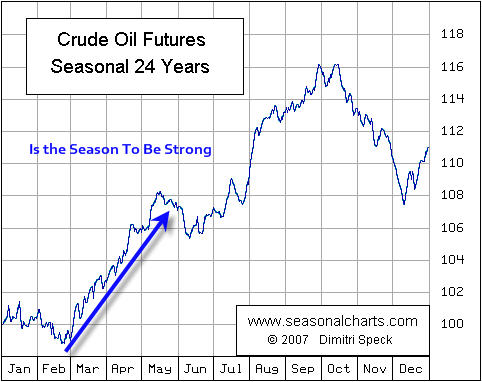

Crude Oil – It’s the Season

It’s the same story as natural gas above….

Higher prices seem to be where the best odds are.

Energy Trading Conclusion:

As a technical analyst the above charts are pointing to higher prices in the coming weeks for natural gas and crude oil, which is exciting for us all. BUT when things are this perfect looking we must be very cautious as the market has way to suck traders into these “perfect setups” and spit us out a couple days later for a nasty loss.

Understanding how the market moves is crucial for avoiding and/or minimizing losses when trades go against us. That is why I continue to wait for my signature low risk setup before putting any money to work.

My focus is to take the least amount of trades possible each year, only focusing on the best of the best setups. My low risk setups require risk downside risk to be under 3% for the investment of choice. and the broad market needs to be showing signs of strength as well. I use several different types of analysis to confirm if a setup has a high probability of winning and those which do are the trades I take along with my subscribers.

It is very important to wait for the market to confirm a move higher before taking a position when there is this type of setup. The market could go either way quickly and jumping the gun is not a safe bet.

If you would like to receive my Free energy Trading Reports fill out the form below:

Chris Vermeulen

www.GoldAndOilGuy.com