Nov 4th, 2009

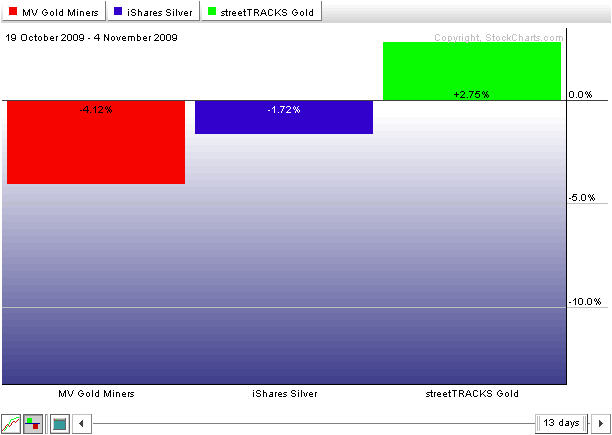

Precious Metals ETF have gone wild the past 2 weeks. Last week we saw gold and silver prices drop sharply as it shook out short term trader’s stop orders before breaking out and moving higher. Also there is a disconnect between the gold and the dollar.

Energy commodities like natural gas and crude oil are moving in opposite directions and look to be picking up speed. Natural gas is losing pressure and oil is on fire.

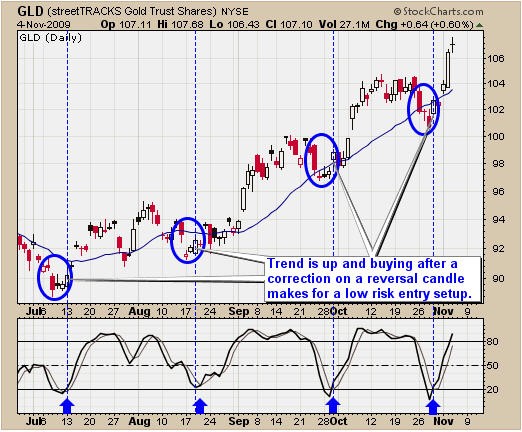

GLD ETF Trading – Pivot Trading Low

Last week we had our pivot trading low generate another buy signal for gold. Trading pivot lows is a simple trading strategy. I call them low risk setups and take advantage of buying a stock, commodity or currency after a pullback to support and when a reversal candle is formed. This chart clearly shows when you are trading with the trend buying on the dips is generally a low risk play with great up side potential.

Gold Bull Market Pivot Trading Low

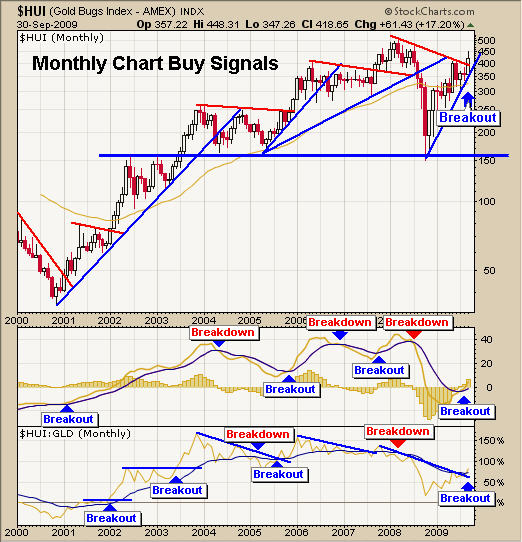

Precious Metals ETF Trading – Gold Bullion Takes Control

This is a chart which shows the performance of gold stocks (red), silver bullion (blue) and gold bullion (green). As you can see the past 2 weeks while the market has been selling down precious metals stocks have been hit harder than silver and gold.

Because of the heavy selling in stocks recently the smart money had been going into commodities especially gold bullion. Gold stocks are a great play but this is telling us investors feel safer in physical bullion than stocks.

Gold is the most known precious metal and safe haven which is why it’s holding value better than silver and stocks. This week we are seeing gold become more valuable in several major currencies which means gold is actually making a real move higher.

Gold Bullion, Silver Bullion, Precious Metal Stocks

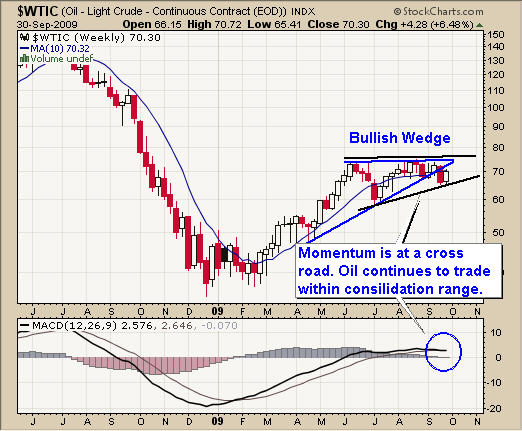

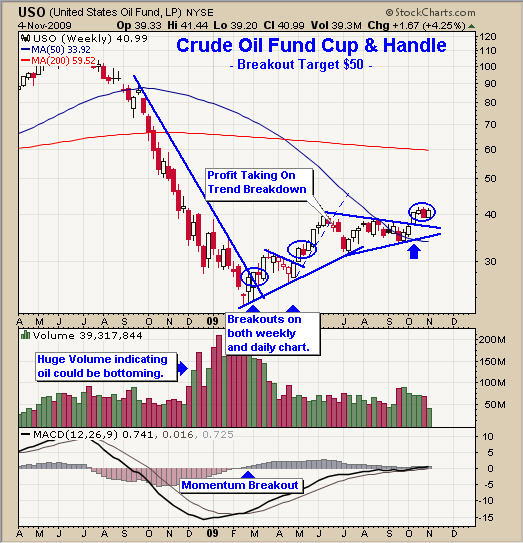

USO ETF Trading – Breakout & Bull Flag

Crude oil has had some great breakouts this year and it looks like we are about to get another buy signal shortly. We had a breakout in Oct from the large pennant and are now flagging which is very bullish. We could see USO reach $50 in the next month or two.

Crude Oil Bull Market Breakout

UNG ETF Trading – Pivot Low or Waterfall Sell Off?

Natural gas is at a crucial level for a higher low bounce or another massive panic sell off. Trading right now with UNG is a 50/50 shot so we will just have to wait and let things unfold more before taking any action.

Natural Gas Pivot Low Bear Market

The Stock Markets, Precious Metals & Energy Trading Conclusion:

The market is starting to feel a little squirmy as it tries to find support. Small cap stocks continue to get crushed while blue chip (large cap) stocks are holding more of their value. Gold has broken higher this week while silver and precious metal stocks under perform their big sister Yellow Gold.

Crude oil is holding up nicely forming a 3 week bull flag and showing signs of life while natural gas continues to get hammered.

The market has been jumpy the past 2 weeks because market participants are very uneasy about the future direction of the US dollar.

If you would like to receive these free trading reports join my free list:

Chris Vermeulen