Trading Strategies That Make Sense

& Are Simple To Follow

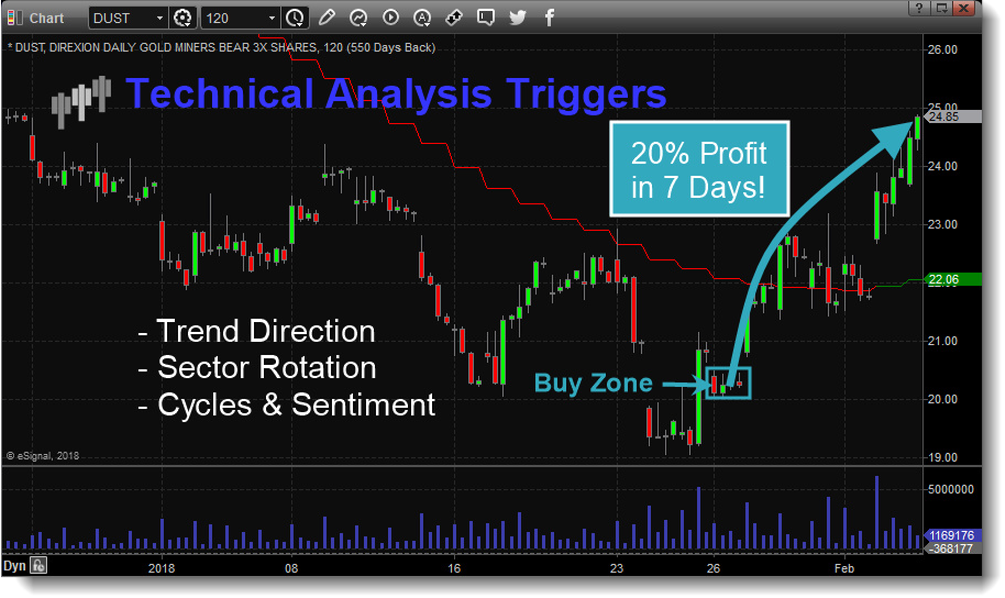

My focus is on trading short-term swing trades that last 1-6 weeks. These trade setups allow us to take advantage of quick, explosive price movements in the market along with trends to provide a steady stream of trades each year. These wave-like patterns are too small for hedge funds to take advantage of and are too lengthy for day traders. This provides us with a sweet spot in the market coupled with my unique and proven forecasting technique giving us a “winning edge,” which we can take full advantage of.