Recent Market Trends Remain In Place – Get Positioned!

What a trading session Wednesday was with the FOMC meeting and the FED coming out leaving the Fed Funds Rate unchanged at 0.25% and saying the economy is looking weak and will not likely to get better any time soon. This wave of negative news triggered a selling spree across the board in stocks, metals, and oil. On the flip side all that money being pulled out of those investments was being dumped into bonds and the dollar currency.

So the question everyone is asking is why almost every asset class sold off after the Federal Reserve’s statement today? The next question is how do we position ourselves to profit?

Understanding how the market moves is not a simple task, if it was that easy everyone would be pulling money out of the market on a daily or monthly basis. With that being said, moves can be anticipated if enough indicators are pointing to the same outcome.

Gold, SP500 and Oil 10 Minute Charts Showing Todays 2:15 FED News

Over the past few weeks we have been seeing stocks, oil, and gold turn bearish with similar price and volume action. Having three major investment vehicles hinting towards a move in the same direction as each other increases the odds for that move to occur. With the Fed coming out with negative news and no quantitative easing on tap, a rally in the dollar was triggered because inflation (printing of money) is not in the picture for some time still.

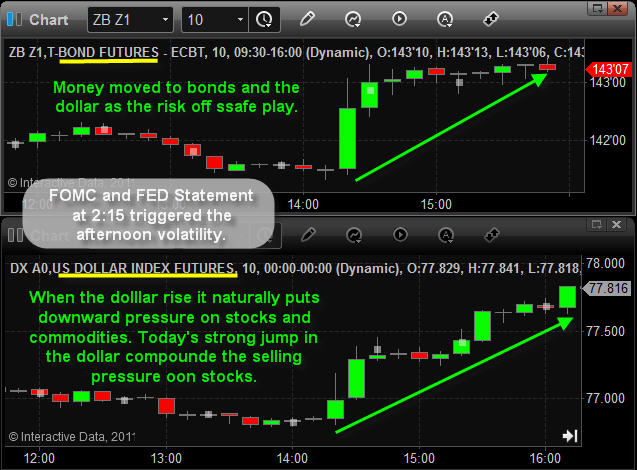

Bonds and Dollar Index 10 Minute Charts Showing Today’s 2:15 FED News

Now if we look at the safe havens we can see the positive side to today’s news.

Bonds have been trading higher for some time and the key in trading is to trade with the trend. Though it’s easier said than done… In this morning’s pre-market analysis I talked about bond prices and how they are looking toppy but we need one more large surge higher before I will consider looking for a short trade setup. Today’s news sent bonds surging higher which I feel will happen for a few more days. Once the momentum stalls out of bonds, then I may be looking to short bonds using the TBT inverse bond fund.

The fact that there is no quantitative easing planned is bullish for the dollar. Stepping back a few weeks we have seen the dollar index rally very strongly. The move up was an impulse wave meaning a trend reversal from the multi-month down trend. Knowing that the dollar had shifted from a down trend to a strong uptrend prior to the Fed’s announcement today was our tip off to being long the dollar several days ago at a much lower price level.

Mid-Week Market Trend Conclusion:

In short, I feel the intermediate trend (5-20 days) remains firmly down for stocks and crude oil. Silver is more of a wild card because it is more of an industrial metal/speculative investment and it can move at times with gold or down with stocks…

Looking at gold. I am bullish on gold long term but at this time I remain neutral until I see how the next couple trading sessions play out.

Bonds I remain neutral because they have moved a long way without any substantial pause or pullback and I feel one really positive headline news item could send bonds sharply lower.

The dollar index shifted from a strong down trend to a very strong up trend last month and I feel we could see another substantial rally unfold. I have an 80.00 – 81.00 price target on the dollar index at this time.

Consider joining me at TheGoldAndOilGuy for ETF trade ideas on the SP500, Oil, Gold, and Silver with great accuracy. Check it out at http://www.thegoldandoilguy.com/free-preview.php

Chris Vermeulen