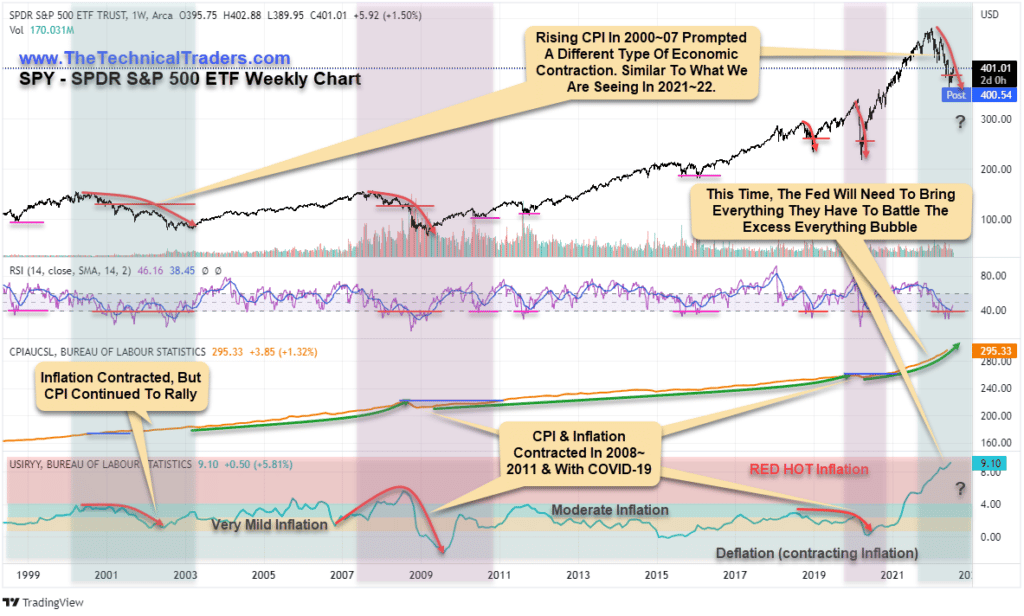

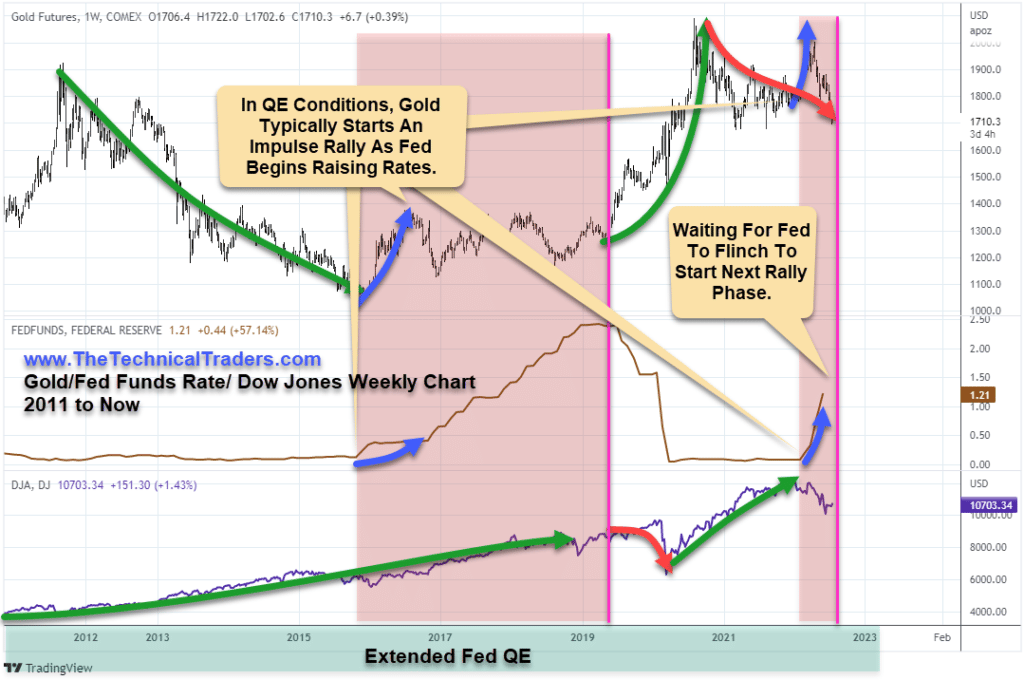

Traders expect the U.S. Fed to soften as Chairman Powell suggested they have reached a neutral rate with the last rate increase. The US stock markets started an upward trend after the last 75bp rate increase – expecting the U.S. Fed to move toward a more data-driven rate adjustment.

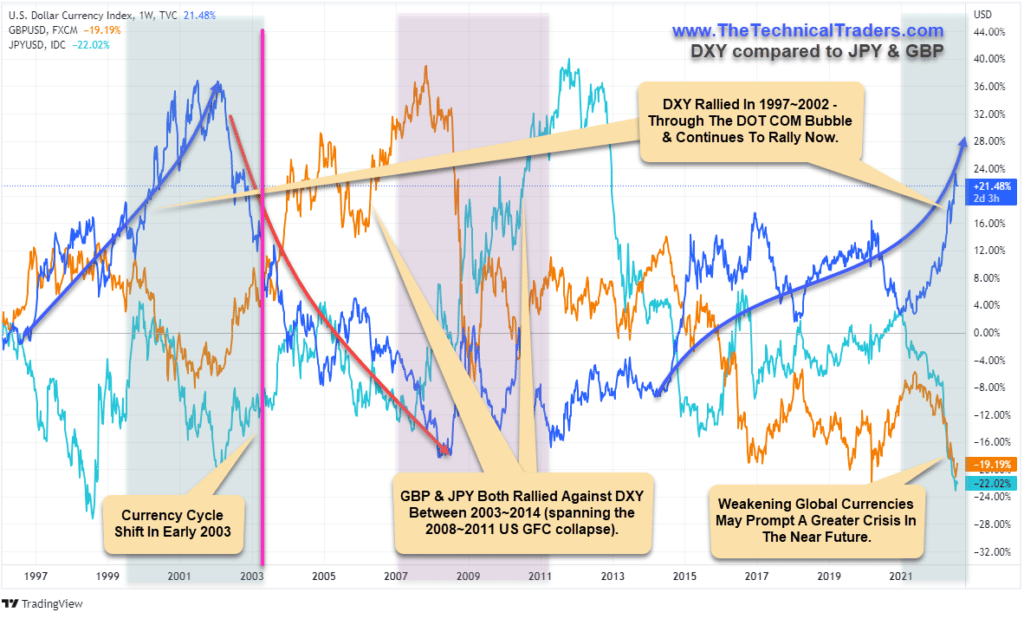

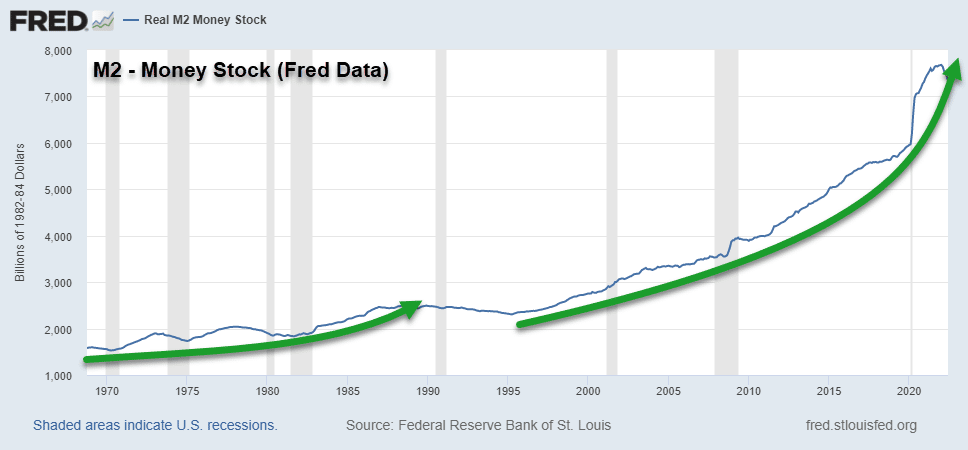

My research suggests the U.S. Federal Reserve has a much more difficult battle ahead related to inflation, global market concerns, and underlying global monetary function. Simply put, global central banks have printed too much money over the past 7+ years, and the eventual unwinding of this excess capital may take aggressive controls to tame. Investors have looked for asset revesting advisors but they really don’t exist yet.

Real Estate Data Shows A Sudden Shift In Forward Expectations

The US housing market is one of the first things I look at in terms of consumer demand, home-building expectations, and overall confidence for consumers to engage in Big Ticket spending. Look at how the US Real Estate sector has changed over the past five years.

The data comparison chart below, originating from September 2017, shows how the US Real Estate sector went from moderately hot in late 2017 to early 2018; stalled from July 2018 to May 2019; then got super-heated in late 2019 as extremely low-interest rates drove buyers into a feeding frenzy.

As the COVID-19 virus initiated the US lockdowns in March/April 2020, you can see the buying frenzy ground to a halt. Between March 2020 and July 2020, Average Days On Market shot up from -8 to +17 (YoY) – showing people stopped buying homes. At this same time, home prices continued to rise, moving from +3.3% to +14% (YoY) by the end of 2020.

The buying frenzy then kicked back into full gear and continued at unimaginable levels throughout 2021 as interest rates stayed near lows and FOMO increased. Over the past 7+ years, the excess capital meant buyers could sell their existing homes, relocate to a cheaper area, avoid COVID risks, and reduce their mortgage costs with almost no risks. This “great relocation” event likely sparked the high inflation/CPI trends we are battling right now.

(Source: Realtor.com)

Extreme Easy Monetary Policies May Prompt A Harsh U.S. Fed Action In The Future

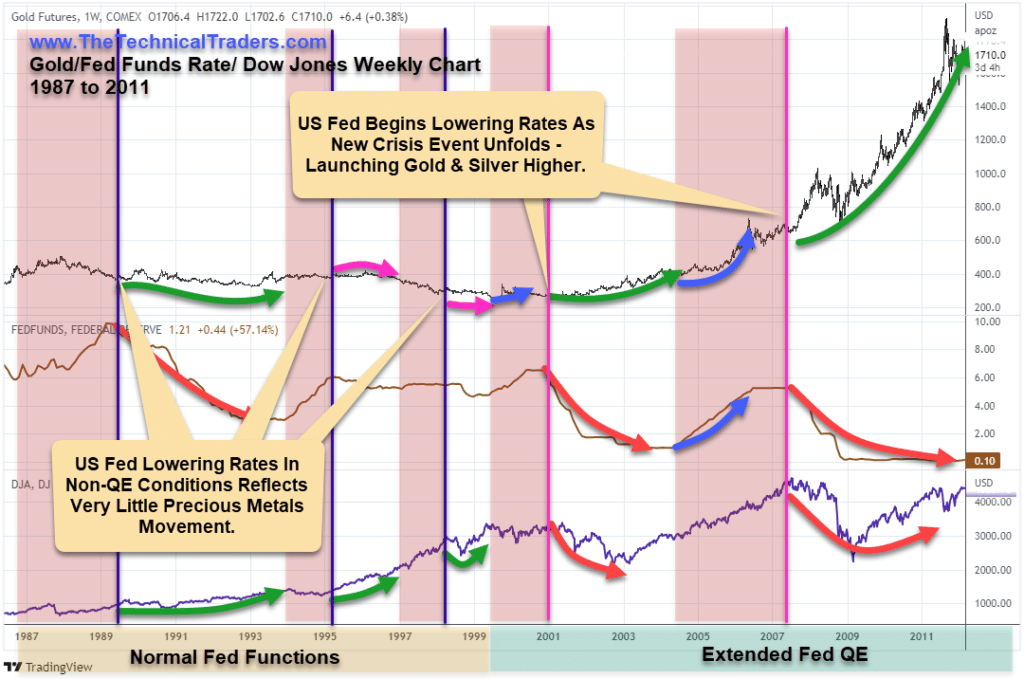

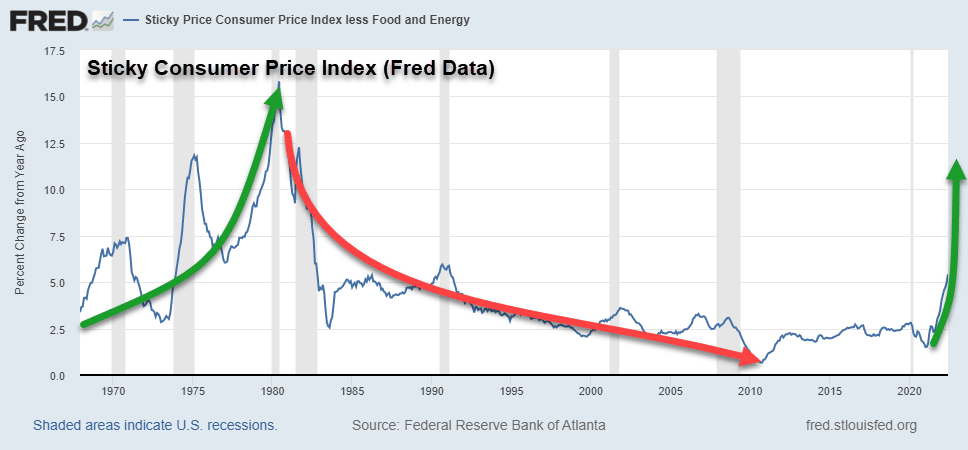

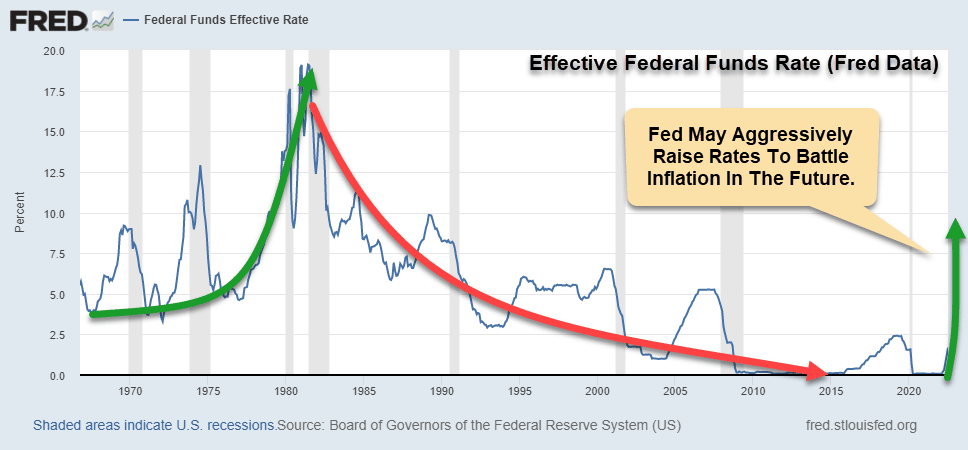

Traders expect the U.S. Federal Reserve to softly pivot away from rate increases after reaching a “normal level.” I believe the U.S. Federal Reserve will have to continue aggressively raising rates to battle ongoing inflation and global concerns. I don’t believe traders have even considered what may be necessary to break this cycle – or are simply hoping they never see 14% FFR rates again (like we saw in the 1980s).

The harsh reality is the excess capital floating around the globe has anchored an inflationary trend that may be unstoppable without central banks taking interest rates to extremes. There was only one other period where I see similarities between what is taking place now and the recent past – 1970~2003.

Throughout that span of time, the U.S. Federal Reserve moved away from the Gold Standard and entered an extended period of money creation. This prompted a big increase in CPI and Inflation, leading to extreme FFR rates above 15% in 1982 to battle inflationary trends (see the charts below). CPI continued above 5% for another 15+ years after 1982 – finally bottoming in 2010.

What if the extended money printing that started after the 2007-08 Global Financial Crisis sparked another excess capital/inflation phase just like the 1970 to 2003 phase? What’s next?

Excess Money Must Unwind Over Time To Prompt A New Growth Phase

My thinking is the 2000~2019 unwinding phase, prompted by the DOT COM bubble, 911 Attacks, and the eventual 2008-09 Global Financial Crisis, pushed the devaluation of assets/excess toward extreme lows. This prompted the U.S. Federal Reserve to adopt an extended easy money policy.

COVID-19 pushed those extremes beyond anyone’s expectations – driving asset prices and the stock market into a frenzy. As inflation trends seem unstoppable, the Fed may need to take aggressive actions to thwart the global destruction of capital, currencies, and economies and avoid a massive humanitarian crisis. Run-away inflation will harm billions of people who can’t afford to buy a slice of bread if it goes unchallenged.

The U.S. Federal Reserve may be forced to raise FFR rates above 6.5~10% very quickly to avoid rampant inflation’s destructive effects. And that means traders are mistakenly assuming the U.S. Federal Reserve will pivot to a softer stance.

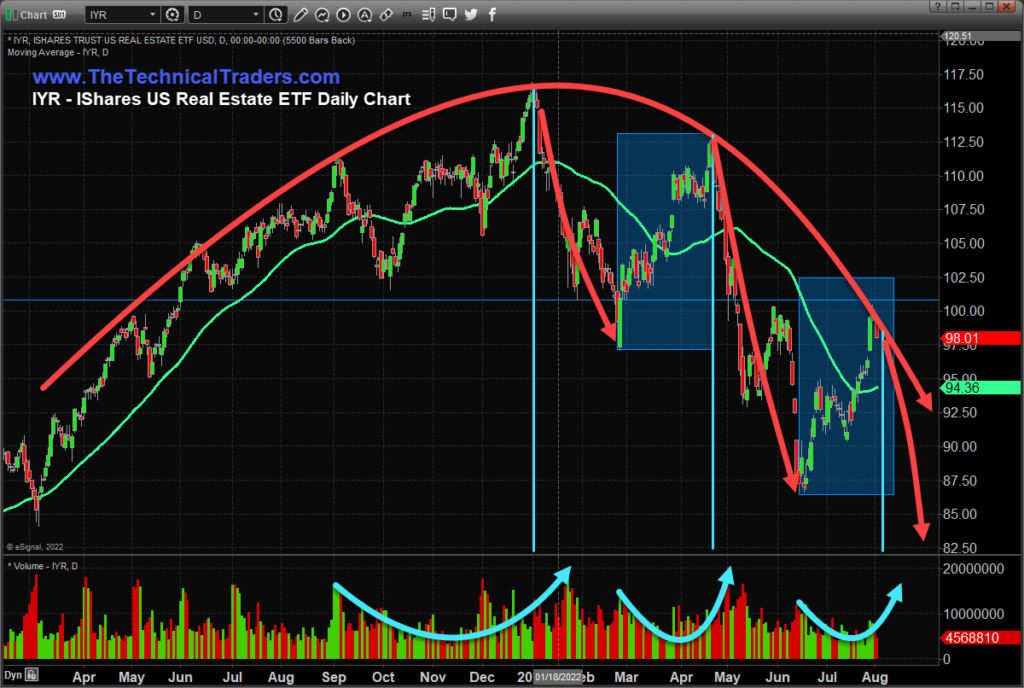

Real Estate Will Be The Canary In The Mine If Fed Stays Aggressive

I believe Real Estate could see an aggressive unwinding in valuation and future expectations if the U.S. Fed continues to raise rates over the next 12+ months aggressively. Once mortgage rates reach 8% or higher, home buyers and traders are suddenly going to question, “where is this going?” and “where will it end?”.

The Fed may have to break a few things to battle inflation trends. This same thing happened in the early 1980s, and real asset growth didn’t start to accelerate until the last 1990s (amid the DOT COM Bubble).

Real Estate & Financials May Show The First Signs Of Stress

I believe IYR and XLF are excellent early warning ETFs for a sudden shift in consumer/economic activity related to future Fed rate decisions. Once the Fed moves away from expected rates/trends, the Real Estate and Financial sectors will begin to react to economic contractions and weakening consumer demand/defaults.

This potential trend is still very early in the longer-term cycle, but I believe traders are falsely focused on a possible U.S. Fed pivot, thinking the Fed will shift away from continued rate increases. I believe the U.S. Federal Reserve must raise rates above 5.5% FFR in order to start breaking inflationary trends. That means FFR rates need to rise 125% or more from current levels (250 bp+) – which may be higher.

HOW CAN WE HELP YOU LEARN TO INVEST CONSERVATIVELY?

At TheTechnicalTraders.com, my team and I can do these things:

- Safely navigate the commodity and crude oil trend.

- Reduce your FOMO and manage your emotions.

- Have proven trading strategies for bull and bear markets.

- Provide quality trades for investing conservatively.

- Tell you when to take profits and exit trades.

- Save you time with our research.

- Proved above-average returns/growth over the long run.

- Have consistent growth with low volatility/risks.

- Make trading and investing safer, more profitable, and educational.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Chris Vermeulen