Read Exclusive Article On CNA-Finance: http://cnafinance.com/the-global-depression-and-deflation-is-currently-underway/7130

Archive for month: October, 2015

Back in August I wrote about MGX Mineral Inc. (Symbol CSE: XMG). There has been some great progress with this company and things continue to look even better.

Technical analysis and trading is my passion and getting involved in new companies which have a quality product, proven management, and have the right timing for entering a market which is close to starting a new bull market is one of the most exciting types of long term investments to watch unfold.

Don’t get me wrong, investments are just that… long term, and take years to unfold, but if you are positioned with the right company at the right time returns can be life changing 3-5 years down the road.

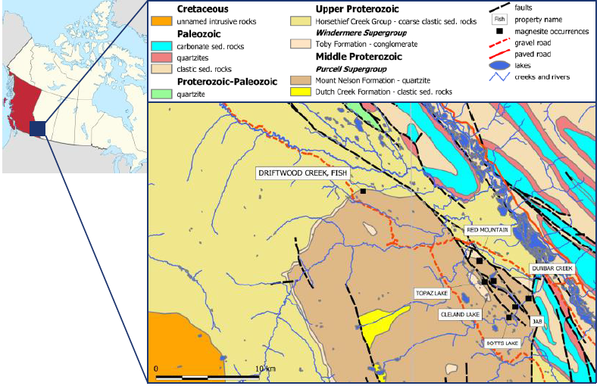

Long story short MGX Mineral’s has what myself and many others believe to be a world class open-pit mine for Magnesite. It’s high-grade mineral, location and potentially lowest processing and shipping costs position this company at the top of my investment list. This is not a 2-3 year mine that will be out of material like most gold and silver mines, this a 100+ year operation in the infancy stage.

This is new company which means two things:

- It’s still unknown and share price is still cheap.

- Share price has been trading at all-time highs which means no overhead sellers/resistance.

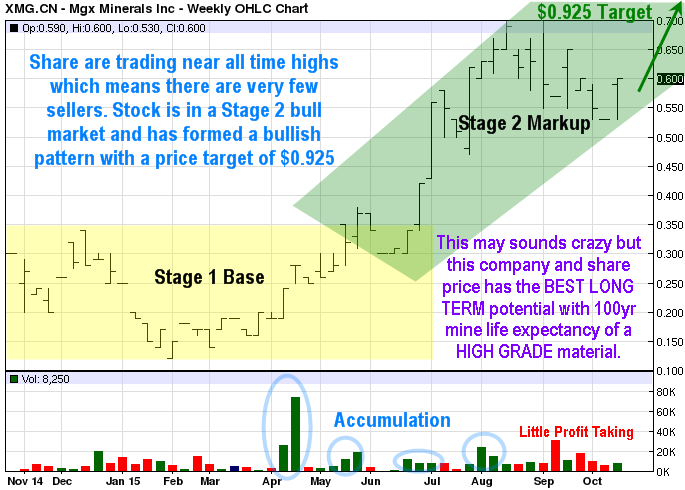

Looking at the chart below we can see share price is rising with a bullish pattern. At this point the chart is indicating the next rally should reach 92.5 cents per share up 50%.

To be honest, I have never had the opportunity to find and be involved with a company that has this much potential long term. Jared the CEO and myself both see this being a billion dollar company way down the road and know that makes this company an incredible value at this price.

My partner Kal Kotecha who helps me find and research these micro cap stock plays for our long term portfolio just release his update which I have added below for you. Check it out!

Kal Kotecha’s Recent MGX Mineral Inc. Report

MGX Minerals Inc. – Analysis

- Steadily growing demand for high grade magnesite at a compound annual growth rate of 6% (Berry, 2015)

- MGX’s strategic partnerships with Eaton Corporation (NYSE: ETN) and Highbury Energy to secure long-term financing support and low-cost energy solutions

- Strong value chain management capabilities derived from the location and geology of Driftwood Creek

- The company’s demonstration of advanced business planning with Driftwood Creek’s near-term cash flow combined with low initial capital expenditures, producing limited investment risk

Drilling Operations

|

DDH |

From (m) |

To (m) |

Interval (m) |

MgO% |

CaO% |

Fe203% |

SiO2% |

LOI% |

|

2015-1 |

6.0 |

63.0 |

57.0 |

43.07 |

1.30 |

1.49 |

4.47 |

48.50 |

|

2015-1 |

81.0 |

121.92 |

40.92 |

43.87 |

0.50 |

1.46 |

6.76 |

45.35 |

|

2015-2 |

2.74 |

45.0 |

42.26 |

42.60 |

0.67 |

1.43 |

7.56 |

46.32 |

|

2015-2 |

54.0 |

91.44 |

37.44 |

41.55 |

0.31 |

1.43 |

11.46 |

42.49 |

|

2015-3 |

0.61 |

65.53 |

64.92 |

40.71 |

0.92 |

1.48 |

13.13 |

40.97 |

|

2015-4 |

30.0 |

128.02 |

98.02 |

44.28 |

0.97 |

1.51 |

3.4 |

48.55 |

Infrastructure Development

Investment Opportunity

Works Cited

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, “has potential to”, or “intends’ or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, products and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the market for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. Junior Gold Report does not take responsibility for accuracy of forward looking statements and advises the reader to perform own due diligence on forward looking numbers or statements.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by MGX Minerals Inc. In addition, the author owns shares of MGX Minerals Inc. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

DOWNLOAD SPECIAL REPORT:

Click Here – http://www.algotrades.net/wp-content/uploads/2015/10/OCT2015.pdf

SPECIAL EXCLUSIVE REPORT: http://www.gold-eagle.com/article/why-fed-needs-go-negative-interest-rates

Treasury Secretary Jacob Lew said the government will run out of money to pay its bills sooner than previously thought around November 5, 2015. Lacking sufficient cash, it would be impossible for the United States of America to meet all of its obligations for the first time in our history.

Again, another year, to increase the USA debt limit by the government. Will monetary and fiscal policy ever return to “sanity”? Will the political leaders ever become brave enough to quit spending more of the taxpayer’s monies than they bring in without fear of losing elections? Will Americans ever elect someone who doesn’t just promise them more and more “stuff,” and who will just start acting responsibly with the nation’s treasury?

Political leaders continue to “kick the can down the road” over and over again. Now, like games that involve kicking something over and over again, it won’t get rid of the economic grim reaper. Their “Keynesian mantra” is that the solution to debt is simply to spend more money. They believe it will stimulate an economic recovery that never occurred in the first place over all these years.

Until a proper resolution is reached to these issues, debt will rule. When a nation loses control of its finances through debt, bad things happen in all other aspects of its existence. It loses its power and survival becomes a challenge and no longer a taken for granted right.

What is really required is the attention to what is really going wrong. There must be a willingness to repair, reform, correct and heal it. This awareness is now growing throughout the world. There is a feeling that something is out of balance financially in the world. The issue of tax reform and getting rid of government waste continues to be discussed and that surely has not helped.

The key of all this will be to get people back to work. The USA “unofficial” unemployment rate is approximately 21%. Let’s correct these policies and activities that aren’t working. Make them work again in new and different ways

Why Is The Federal Reserve Bank of New York So Important?

The Federal Reserve Bank of New York plays a special role in the Federal Reserve System for several reasons. First the reason for the New York Fed’s special role is its active involvement in the bond and foreign exchange markets. The New York Fed houses the open market desk, which conducts open market operations, the purchase and sale of bonds, which determine the amount of reserves in the banking system. This is the process of how the FED creates liquidity and controls the money supply.

The involvement in the Treasury securities market, as well as its walking-distance location near the New York and American Stock Exchanges, the officials at the Federal Reserve Bank of New York are in constant contact with the major domestic financial markets in the United States. In addition, the Federal Reserve Bank of New York also houses the foreign exchange desk, which conducts foreign exchange interventions on behalf of the Federal Reserve System and the U.S. Treasury. Its involvement in these financial markets, means that the New York Fed is an important source of information on what is happening in domestic and foreign financial markets, particularly during crisis periods, as well as a liaison between officials in the Federal Reserve System and private participants in the markets.

Second, its district contains many of the largest commercial banks in the United States, the safety and soundness of which are paramount to the health of the U.S. financial system. The Federal Reserve Bank of New York conducts examinations of bank holding companies and state-chartered banks in its district, making it the supervisor of some of the most important financial institutions in our financial system. Not surprisingly, given this responsibility, the Bank Supervision group is one of the largest units of the New York Fed.

The third reason for the Federal Reserve Bank of New York’s prominence is that it is the only Federal Reserve Bank to be a member of the Bank for International Settlements (BIS). Thus the president of the New York Fed, along with the chairman of the Board of Governors, represent the Federal Reserve System in its regular monthly meetings with other major central bankers and interaction with foreign exchange markets means that the New York Fed has a special role in international relations, both with other central bankers and with private market participants. Adding to its prominence in international circles is that the New York Fed is the repository for over $100 billion of the world’s gold, an amount greater than the gold at Ft. Knox.

Finally, the president of the Federal Reserve Bank of New York, is the only permanent member of the FOMC among the Federal Reserve Bank presidents, serving as the vice chairman of the committee. Each of the Federal Reserve banks is a “quasi-public”, part private and part government, institution owned by the private commercial banks in the district in which they serve. The member banks own stock in their Federal Reserve Bank. This is a requirement of membership. Originally, the FED was not responsible for the health of the economy. . Over time, it acquired the responsibility to promote a stable economy through its control of the money supply and its ability to influence interest rates. It is subject to the influence of Congress because of the legislation that structures it is written by Congress and subject to change at any time. It reports quarterly to the banking committees of the House and the Senate.

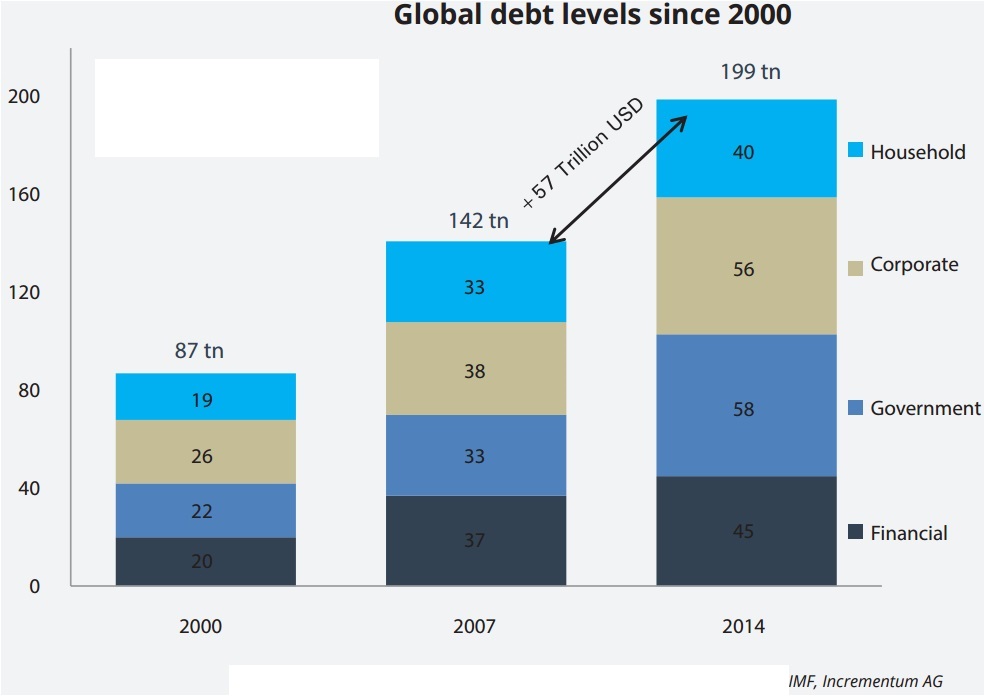

Our debt problem is now out of control. Between 2007 and 2014, the total global debt increased by over 40%. Governments, financials, corporations and households have all increased their absolute debt levels in the last few years. The chart shows that total global debt has reached $200 trillion USD. World global output measured by the gross world product was around 76 trillion USD in 2013. This means that on a global scale we have a debt ratio of approximately 270% of the total yearly world output.

In short, the Treasury is part of the executive branch of the US government. They must follow the direction of the President. The Federal Reserve is independent of the executive branch, almost like the Supreme Court. The voting members of the controlling body of the Fed are nominated by the President. The goal is to limit the impact of short-term politics on decisions about the money supply. Specifically, there is a concern is that if the Federal Reserve was not independent, politicians would seek to obtain short-term economic growth through expanding the money supply, at the cost of long-term inflation. But the fact of the matter is, everyone is addicted to creasing the money supply and every week that goes buy with this artificial stimuli the worse uglier things will be in the future for those not prepared.

A Global Rest is required. Gold is the only asset I know that has no sort of counterparty risk and has been considered to be of value for thousands of years. I follow gold’s price daily. I am currently awaiting for my Proprietary Trend Systems Analytics’ Model to confirm that the bottom is in place so that I may load up on much more.

I believe it is possible that this gold/silver/miners play alone could potentially fund an individual’s retirement if invested in at the correct time. And I will be sharing this with members of my Gold newsletter at: www.TheGoldAndOilGuy.com

Chris Vermeulen