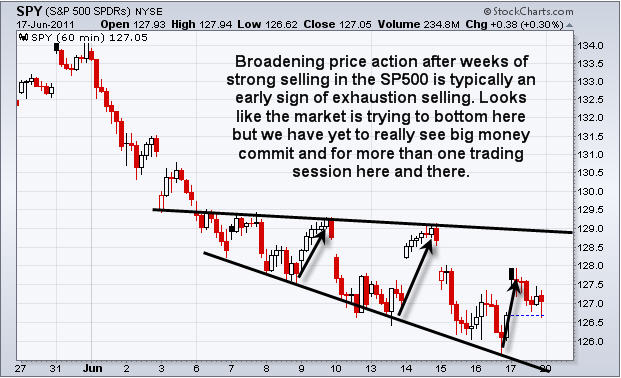

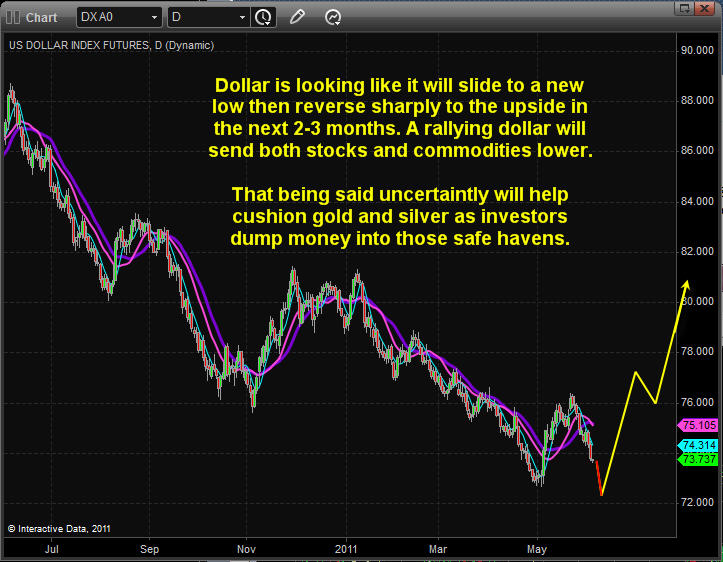

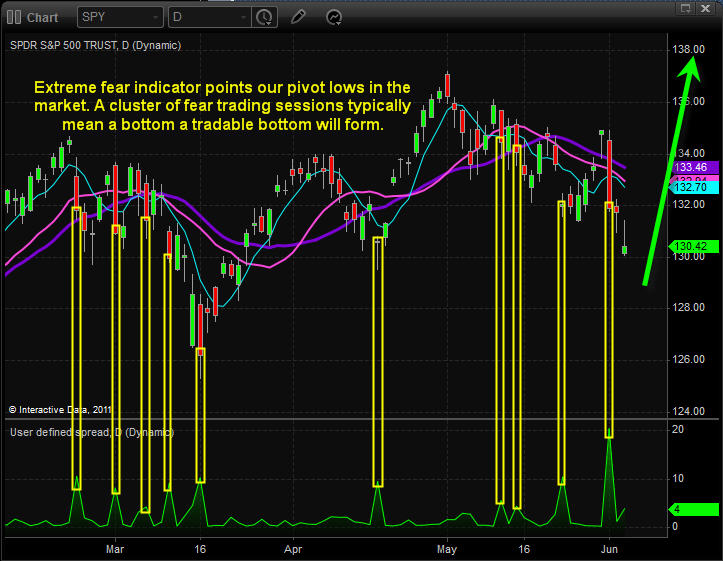

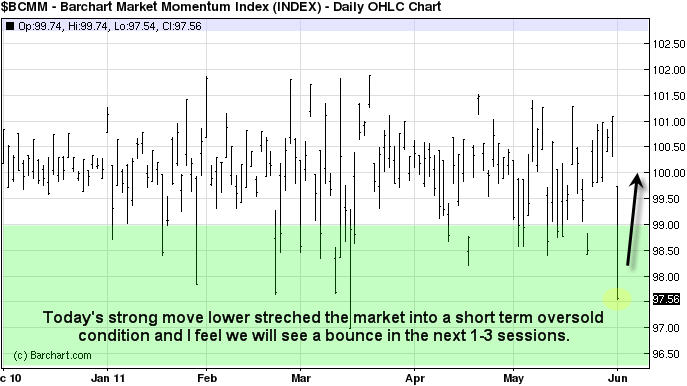

The past month we have seen stocks pick up momentum to the down side after an already very weak month prior (May – Sell in May and go away). This second wave of high volume selling in June was enough to spook the masses out of the market shifting the sentiment from bullish to bearish. But just recently we are starting to see big money accumulate stocks down at these oversold prices, which has me thinking we just may be headed higher sooner than later.

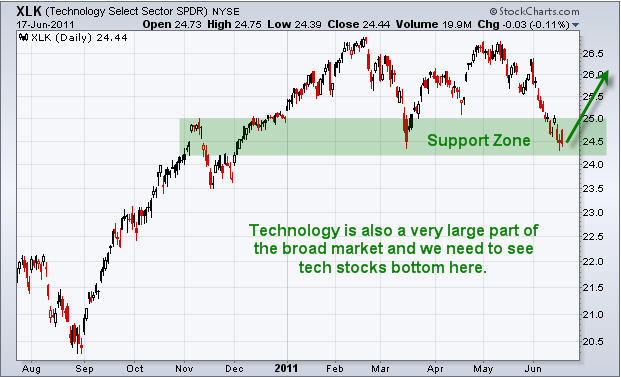

During market reversals we typically see the more sensitive stocks move first, which are the small cap and tech stocks. Then a couple days later we see the brand name stocks (big cap, energy and banking) follow. It’s these large sectors which provide the power in trends.

Taking a look at the graph below you can see on the far right both tech and small caps are leading the market higher and as of today the power sectors (energy and financials) started to move higher also. So if things play out I expect the SP500 which is a basket of the 500 largest companies to follow the small caps higher over the next 1-3 weeks. My trading buddy David Banister over at ActiveTradingPartners.com focuses mainly on small cap stock trading combining crowd psychology and fundamental analysis. his focus is finding stocks ready to explode during bull market advances which may just be starting…

If we take a look at the charts to see how each of these sectors have been performing you will notice that the small caps (IWM) and tech stocks (XLK) broke out one day before the energy and financials did. This is very typical to see and it also works for playing gold. I have seen gold stocks lead the price of gold bullion up to 7 days before gold bullion started to move. It’s these little golden nuggets of info which can not only save you money but make you even more when put to work.

Mid-Week Trading Conclusion:

In short, I feel the market has been forming a base for almost 3 weeks. Just last week we saw the big sectors (financials and energy) reach their key support levels from several months back and that should trigger a sizable bounce and with any luck the start of another leg higher in the market. If you would like to receive these free weekly updated in your inbox please opt-in to my newsletter here: http://www.thegoldandoilguy.com/trade-money-emotions.php

Chris Vermeulen