Gold Newsletter Signals – This week gold signals are popping up everywhere in our collection of gold exchange traded funds. This is a quick gold sector updated on the current price action of some of the best gold exchange traded funds.

How to Find Low Risk High Return Gold Signals

First step is to have a GOAL, Then FIND what trading tools are needed to fit your trading goals.

My Trading Goals

First – My focus is to wait for high probability trades. I do not want to make any more trades than I need to. More Trades = More Risk for my hard earned money. Waiting for a high probability trade is difficult but must be done to generate consistent profits. I wait for gold to find a support or resistance level then look for gold signals in my hand picked collection of gold exchange traded funds like GLD, DGP, GDX and many more…

Secondly – I don’t like to hold stocks or funds any longer than I need to. Most of my trades are short term and only last 2-10 days. Some trades last 1-2 months if gold is making a large move but this is something that only happens every now and then.

Thirdly – My goal is to make 2-5% on each trade and I am happy. With 10-20 trades per year at 5% it’s not a bad return on investment.

Last – Once I am in a trade and it looks like our position is about to roll over, I will lock in some profits by selling some of the position to capture a higher % profit. This is crucial if you want to consistently make money trade after trade.

Find the Best Trading Tools for Reaching the Goal

Experience has proven that the following tools and rules allow me to not only find accurate gold signals but to minimize overall risk and increase the average profit per trade. This took a long time to fine tune, but it all came back to the basic indicators and technical analysis we all learn day one of trading. The only difference is that I have a Goal, Tools and Dedication to Follow Through with my trading model. I share this information and support with members in my Gold Newsletter Service.

My Trading Tools

MACD – A popular technical indicator system that combines several moving averages to better show a stock’s trend and momentum.

Price Relative – Technical indicator that compares the performance of two gold exchange traded funds to each other by dividing their price data.

Breakout Buy Signal – This is when the price of an exchange traded fund closes above our resistance trend line and the MACD cross’ to the upside confirming the trend line break. This is the first requirement for a tradable bounce.

Breakout Sell Signal – This is when the price of an exchange traded fund closes below our support trend line and the MACD cross’ to the downside confirming the trend line break. This is the first requirement for a tradable breakdown.

Upside Reversal – When the price of a fund closes higher than the previous days high.

Downside Reversal – When the price of a fund closes lower than the previous days low.

Maximum 3% Risk Trading Rule – I do not enter any trade in GLD, GDX, ASA, XGD.TO that has more than 3% risk. This actually allows me to miss several trades, which would end up losing.

This trading model is simple. Enter a position when we have a low risk setup, and exit on a trend line break. It’s best not to enter a trade if risk is more than 3%.

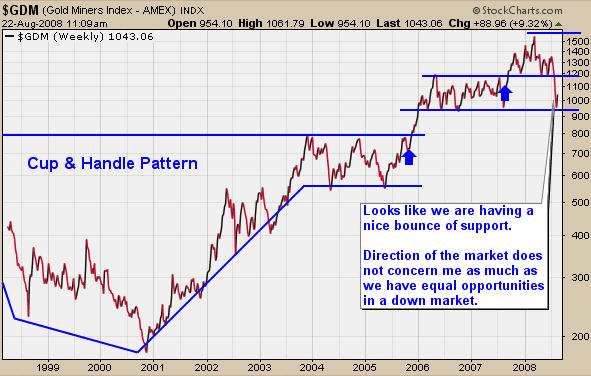

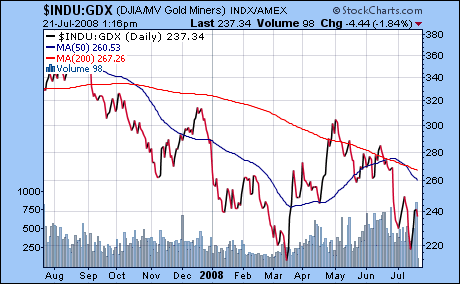

Gold Miners Index – Multi Year Trend Chart

Currently bouncing off support, which increases the probability that we could have a nice rally.

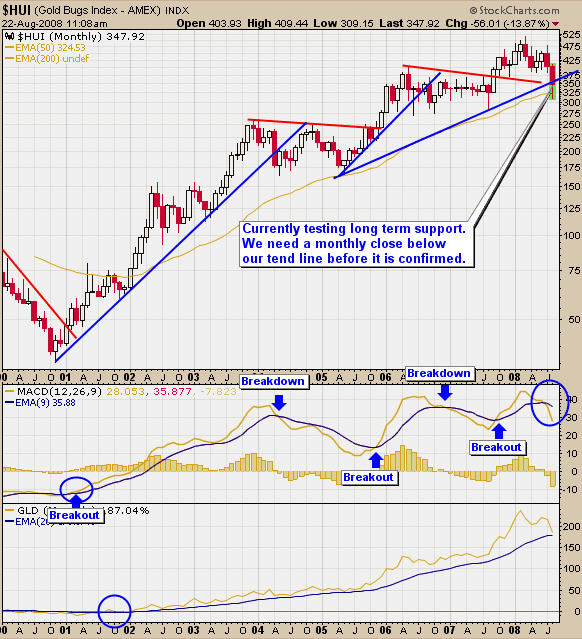

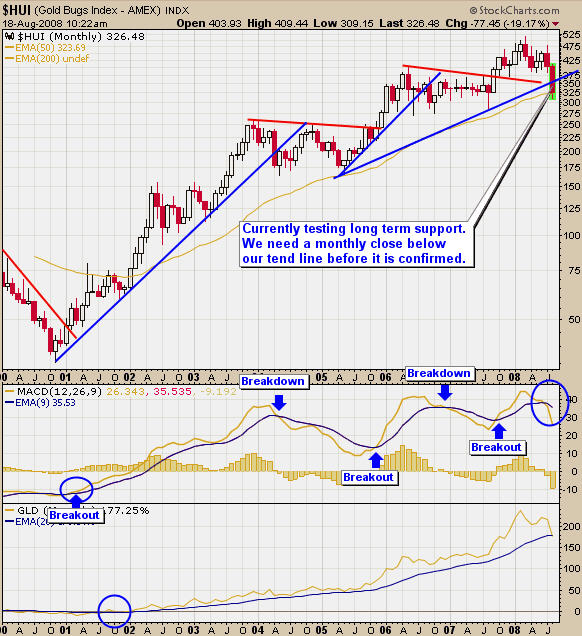

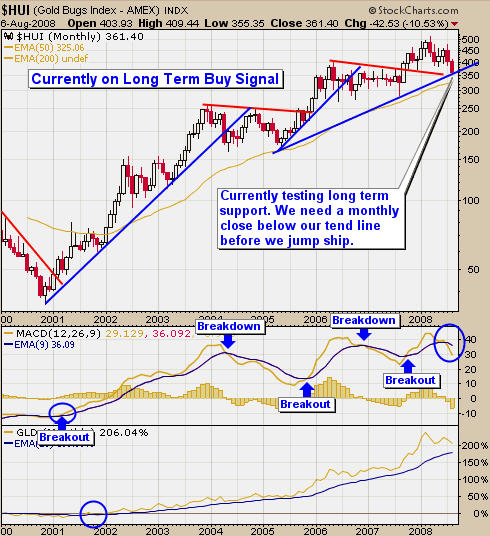

Gold Bugs Index – Monthly Gold Signal Trend Chart

The Monthly Gold Bugs chart is trying to give us a sell signal, but gold stocks are making a strong push higher.

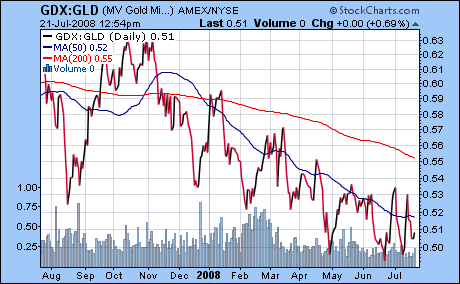

$HUI: $GOLD Ratio Chart – Weekly Gold Signals

Looks like the price of gold stocks have corrected and ready for rally

Gold Bugs Index – Daily Gold Signals

The HUI is my barometer to gauge the strength of a potential gold trade.

GLD Gold Exchange Traded Fund – Gold Trading Signal

GLD is a low risk trading vehicle providing the best win/lose ratio of any other fund I have traded.

DGP Exchange Traded Fund – Gold Trading Signal

DGP is a leveraged gold ETF providing twice the price movement of GLD.

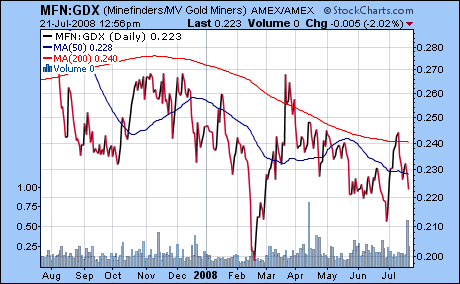

GDX Exchange Traded Fund – Gold Trading Signal

This gold exchange traded fund holds a basket of gold stocks.

XGD.TO Canadian Exchange Traded Fund – Gold Trading Signal

Gold exchange traded fund for Canadian traders.

Finding low risk trading signals is a simple process but entering at the right time is the key.

Conclusion:Gold’s recent price action has not been easy for most traders. Above are the basics of what I look for when looking for gold signals and trading. If you have any questions please send me an email.

Technorati Profile